Week 1: Bitcoin—Known by All, Understood by Few

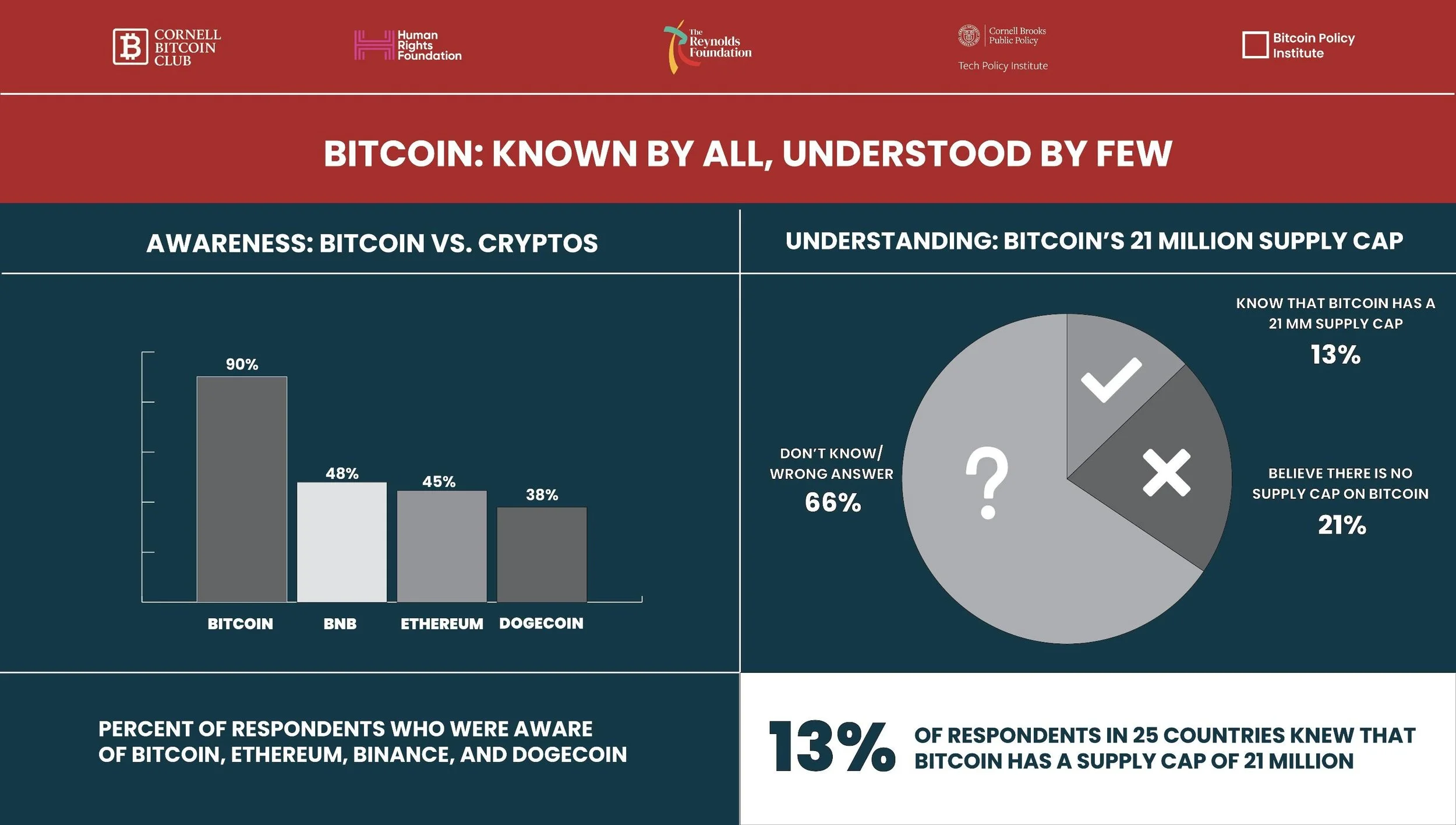

A majority of people say they’ve heard of Bitcoin. Very few can explain it.

Bitcoin’s branding is among the strongest in the world. But beneath the surface lies a striking disconnect:

📌 85% of Americans (~290 million) say they’ve heard of Bitcoin

📌 38% of Americans (~128 million) say they feel knowledgeable about it

📌 6% of Americans (~20 million) know it has a fixed supply of 21 million bitcoin.

Even in bitcoin-forward nations, this core property—arguably the most important—is almost universally unknown, even among those who use it.

This week, we explore the gap between awareness, knowledge, and understanding—and why that gap matters.

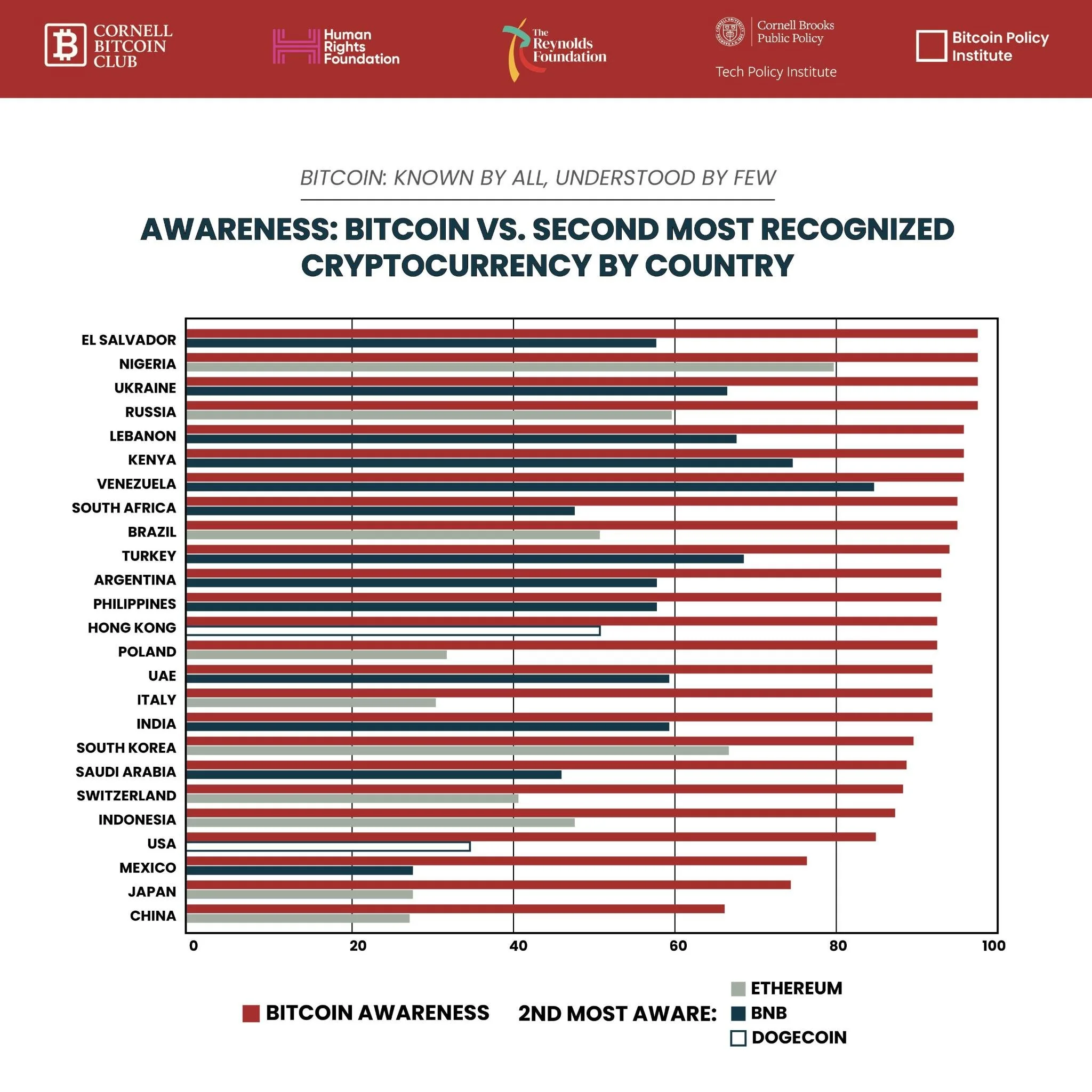

🌐 Awareness Is Everywhere

Bitcoin is one of the most widely recognized words on the planet. Across nearly every country in our 25-country study, over 85% of people report having heard of it.

But things get interesting when we ask what else they’ve heard of. The second-most recognized cryptocurrency varies: :

🔸 BNB leads in Venezuela (85%), Kenya (75%), and Turkey (69%)

🔸 Ethereum dominates Nigeria (80%), South Korea (67%), and Russia (60%)

🔸 In the United States? It’s Dogecoin (yes, really) at 35%, just ahead of Ethereum at 32%

Awareness alone doesn’t tell us much about use or trust. But it does shape perception—and often misperception.

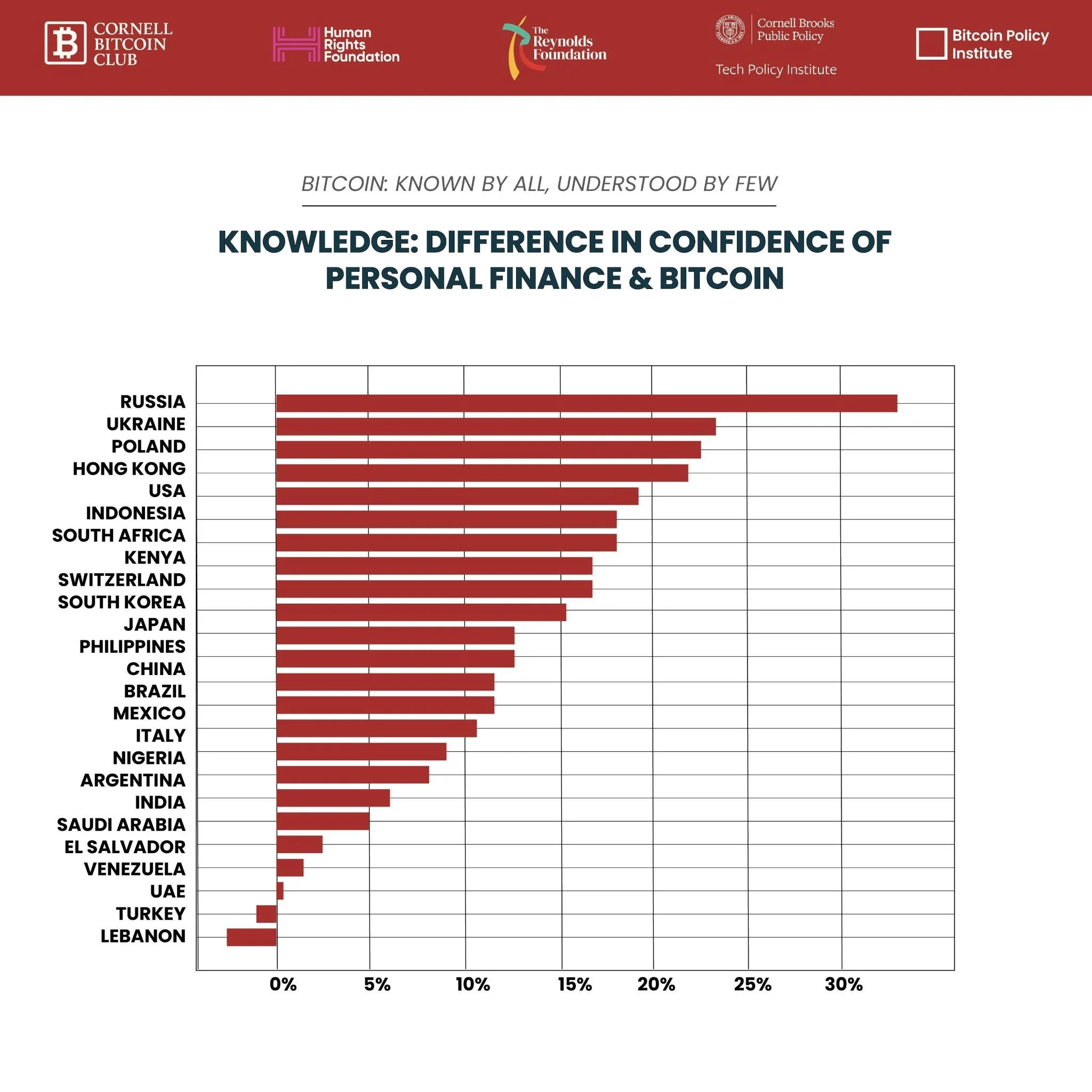

🧠 Knowledge Is Confident, But Conditional

While awareness is high, confidence in bitcoin knowledge is much lower.

In 23 out of 25 countries, people say they feel more confident in their understanding of personal finance than they do of bitcoin.

This suggests that Bitcoin has not yet been internalized as part of broader financial literacy. It's still seen as an exception—not something woven into everyday economic thinking.

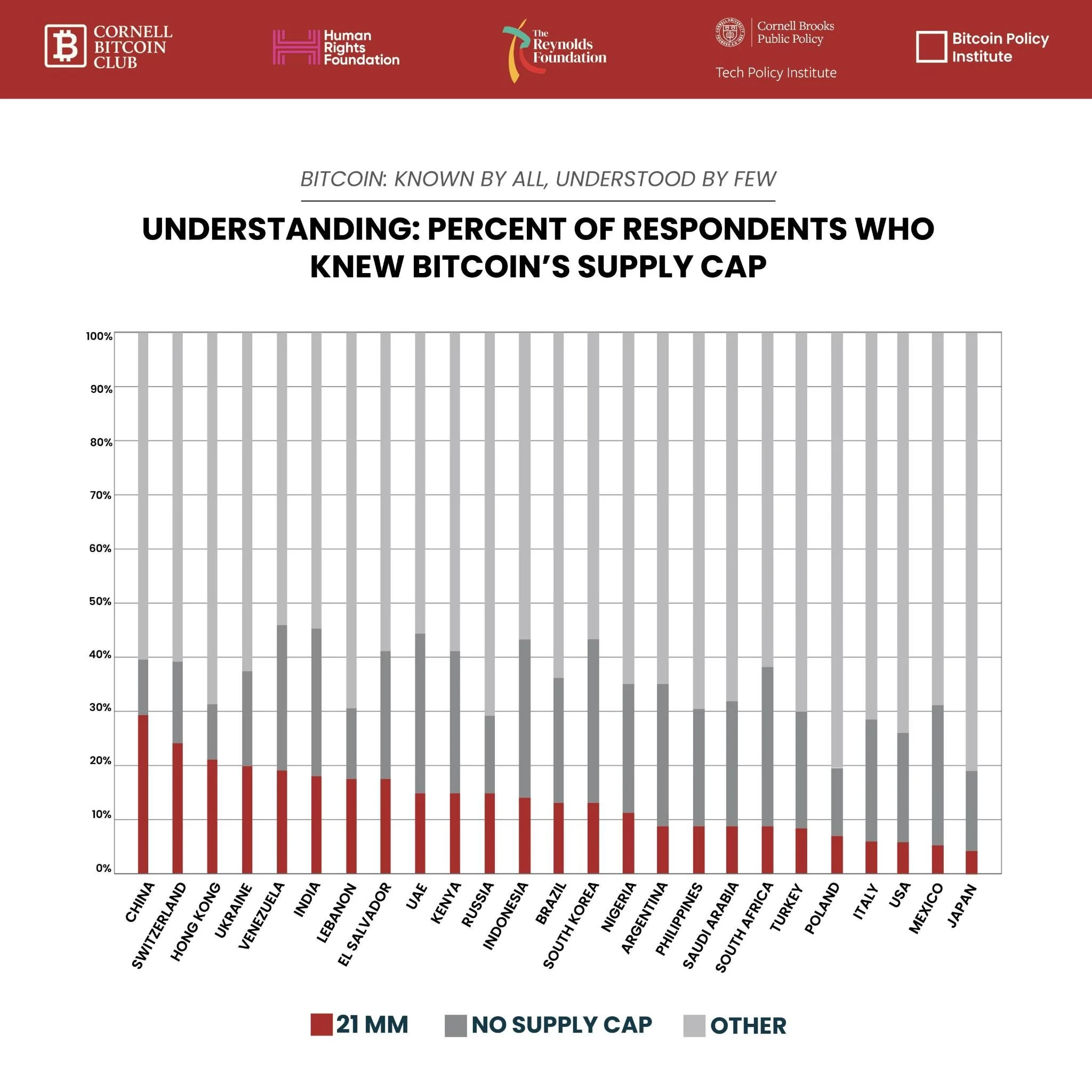

💡 Understanding: The 21 Million Question

One of Bitcoin’s defining properties is its fixed supply: 21 million coins, ever.

But almost no one knows that.

Only 4 countries—🇨🇳 China, 🇨🇭 Switzerland, 🇭🇰 Hong Kong, and 🇺🇦 Ukraine—had more than 20% of respondents correctly identify this figure.

In nearly every other country, this foundational truth is misunderstood, unknown, or overlooked—even among people who own Bitcoin.

🔍 Why This Gap Matters

✅ Awareness is high

🤔 Knowledge is uneven

📉 Understanding is low

Bitcoin has gone mainstream in name—but not in comprehension.

And this matters, because true adoption depends on understanding. Without it, Bitcoin risks being lumped into the same mental bucket as hype cycles, price speculation, and get-rich-quick schemes.

The education gap reveals a deeper truth: Bitcoin hasn’t yet reshaped how most people think about money.

Maybe it’s time to ask: Have we ever had a wide-scale understanding of money in the first place?

📘 What’s Next?

As we continue our 10-week journey through the global Bitcoin and financial freedom study, we’ll dig deeper into questions of ownership, trust, opt-in behaviors, and the real conditions under which bitcoin becomes not just a word—but a tool.

In the meantime, you can explore the open-source research at:

🔗 www.cornellbitcoinclub.org

Let’s build a future where people don’t just know of Bitcoin. They understand what it is—and why it matters.