Cornell Brooks Tech Policy Institute

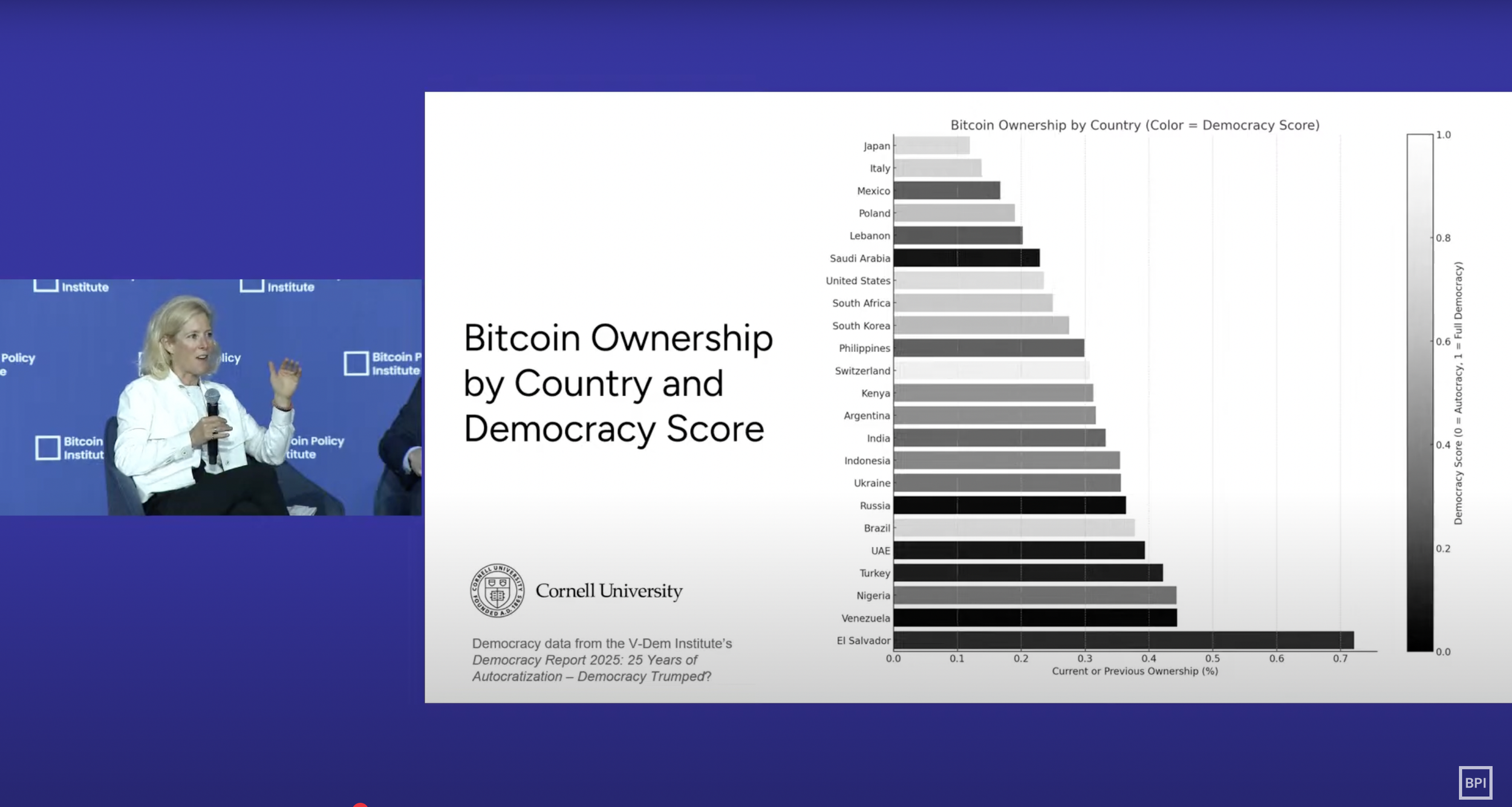

GloBAl Bitcoin Adoption Study

AbOUT

The Cornell Bitcoin Adoption Study is a global research initiative investigating how bitcoin adoption relates to financial inclusion, agency, and community resilience across diverse geographies. With 25,000+ survey responses and 250+ interviews across 25 countries, our goal is to provide the most comprehensive, human-centered understanding of bitcoin adoption to date.

We believe this moment is historically significant: for the first time, a monetary system is being adopted voluntarily rather than imposed. We're here to study what that means - and for whom.

Why this STUDY matTers

Led by researchers at Cornell University’s Brooks School Tech Policy Institute, the study focuses on the social, economic, and political dimensions of Bitcoin adoption around the world.

Our research draws on:

Quantitative survey data from tens of thousands of respondents

Qualitative interviews with individuals, merchants, policymakers, and activists

Comparative analysis across regions and demographics

We aim to create a rigorous, neutral, and open-access body of research that can support better policy, advocacy, and community efforts around financial freedom.

This study is supported by grants from the Human Rights Foundation and the Reynolds Foundation. We’re grateful for their commitment to open research and financial freedom.

Resources

We’re committed to open-sourcing all of our research, data, and tools. Everything we produce - surveys, interview guides, country profiles, and visualizations - is freely available for public use, remixing, and replication. Knowledge should be a public good.

-

We are publishing rolling insights as we analyze survey data and interview transcripts. Our findings explore themes such as:

Motivations for bitcoin use

Trust in institutions vs. peer networks

Differences between regions, age groups, and gender

Bitcoin as protest, survival tool, or investment

Each insight is presented with transparency and academic rigor, accompanied by charts and excerpts from the field.

-

See where our work has been featured and how it’s shaping conversations on financial inclusion, human rights, and digital money.

📰 The National Interest Article, August 2025

🗣️Africa Bitcoin Conference Diaspora, August 2025

🗣️ What Bitcoin Did Podcast, July 2025

🗣️ Bitcoin Policy Institute Summit, July 2025

🗣️ Oslo Freedom Forum, June 2025

🔗 Data Infographic, June 2025

🗣️ Bitcoin Policy Institute, April 2025

🗣️ Africa Bitcoin Conference, December 2024

📰 BTPI will research relationship between Bitcoin and financial freedom, May 2024

-

In the spirit of transparency and collaboration, we are committed to publishing anonymized datasets, codebooks, and documentation for public use.

📊 Survey Data (aggregate)

📁 Interview Protocols

📄 Country Profiles

📌 Methods & Ethics Statements

All data is released under a Creative Commons license.

-

Our interactive tracker offers an evolving snapshot of Bitcoin adoption across the countries we’re studying. Click on each country to explore:

Key statistics from surveys and interviews

Emerging themes and challenges

Grassroots initiatives, regulatory climate, and social context

This tool is built to support researchers, entrepreneurs, policymakers, and educators.

-

This report is the culmination of a 2 year research effort to understand how Bitcoin is being adopted around the world and why.

What we’ve found is not just a financial story, but a deeply human one. The report combines:

Quantitative survey analysis, including demographics, motivations, obstacles, and patterns of use

Qualitative excerpts from interviews with students, merchants, workers, activists, and local leaders

Comparative country-by-country overviews to highlight structural differences in how Bitcoin enters people’s lives

We explore key themes such as:

Bitcoin as a tool for freedom, survival, or status

Regional dynamics: grassroots innovation vs. top-down regulation

Trust in institutions vs. peer-to-peer networks

The role of youth, women, and marginalized communities in shaping adoption

Bitcoin and the architecture of choice: is this the first monetary network being adopted voluntarily?

This report is designed to be accessible to policymakers, educators, students, builders, and anyone seeking a grounded, global understanding of Bitcoin as a phenomenon shaped by people, not just markets.

[📄 Download the Full Report]

[📘 Executive Summary PDF]

[📊 View Charts and Data Visuals]

[🧠 Read the Methodology]

Meet the Team