Week 10: Catalysts of Adoption

Across 25 countries, people are weighing a fundamental question: Is bitcoin a tool for financial freedom—or not?

This week concludes our 10-week data release, exploring what drives bitcoin adoption, what holds it back, and what it might take to reach the next generation of users.

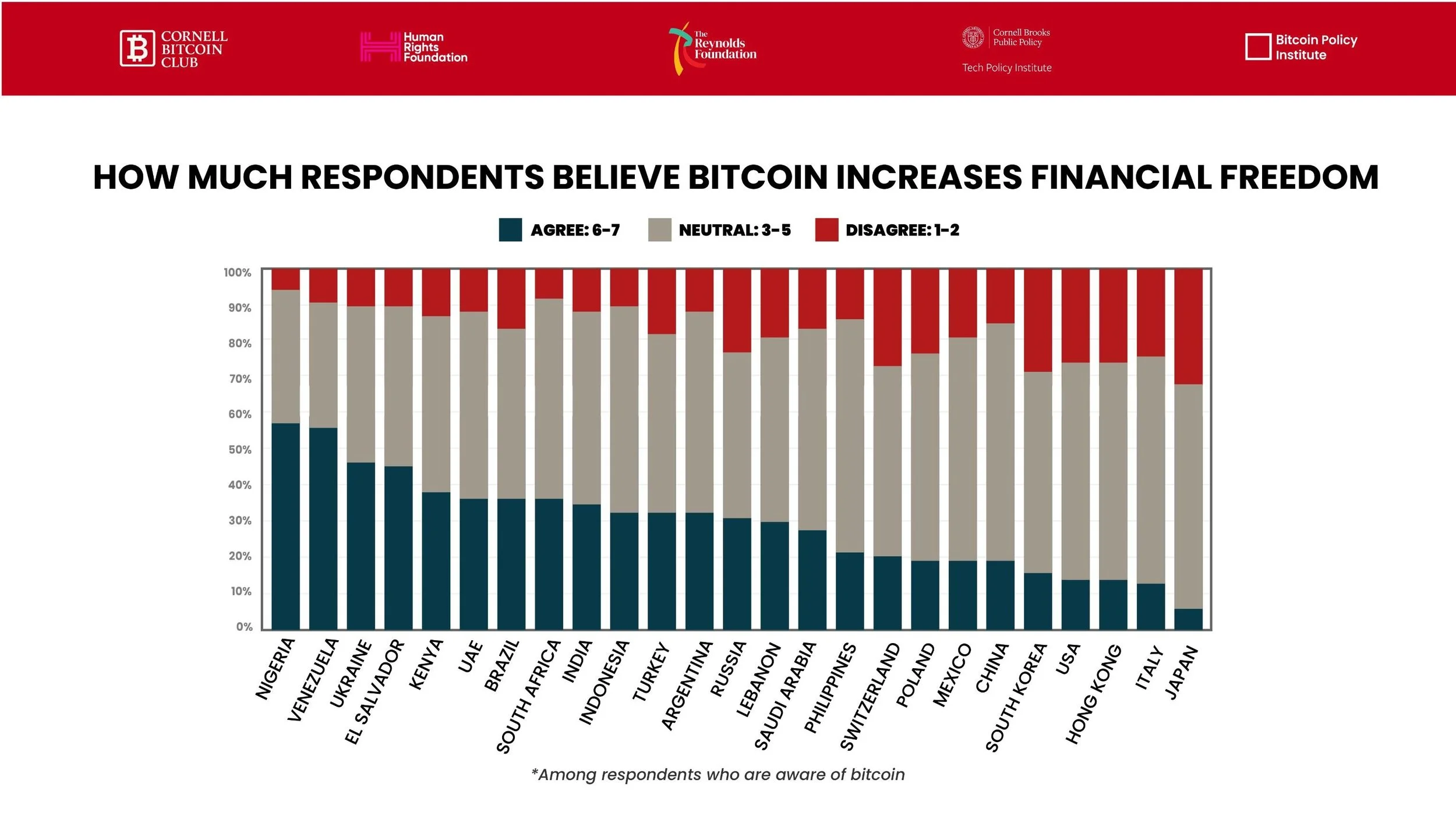

💡 Does Bitcoin Increase Financial Freedom?

Among those aware of bitcoin, belief in its ability to increase financial freedom varies dramatically across countries.

Strongest believers:

🇳🇬 Nigeria (57.10%) and 🇻🇪 Venezuela (56.02%) show the highest agreement

🇺🇦 Ukraine ranks third (46.52%)

Most skeptical:

🇯🇵 Japan (32.95%) shows the highest disagreement

🇺🇸 United States (28.54%) and 🇨🇭 Switzerland (27.50%) follow closely

🇮🇹 Italy (12.96%) and 🇰🇷 South Korea (13.55%) have the lowest agreement

Takeaway: Belief in bitcoin’s liberating potential is strongest where local currencies are volatile or banking access is limited—and weakest in countries with stable economies and established financial systems.

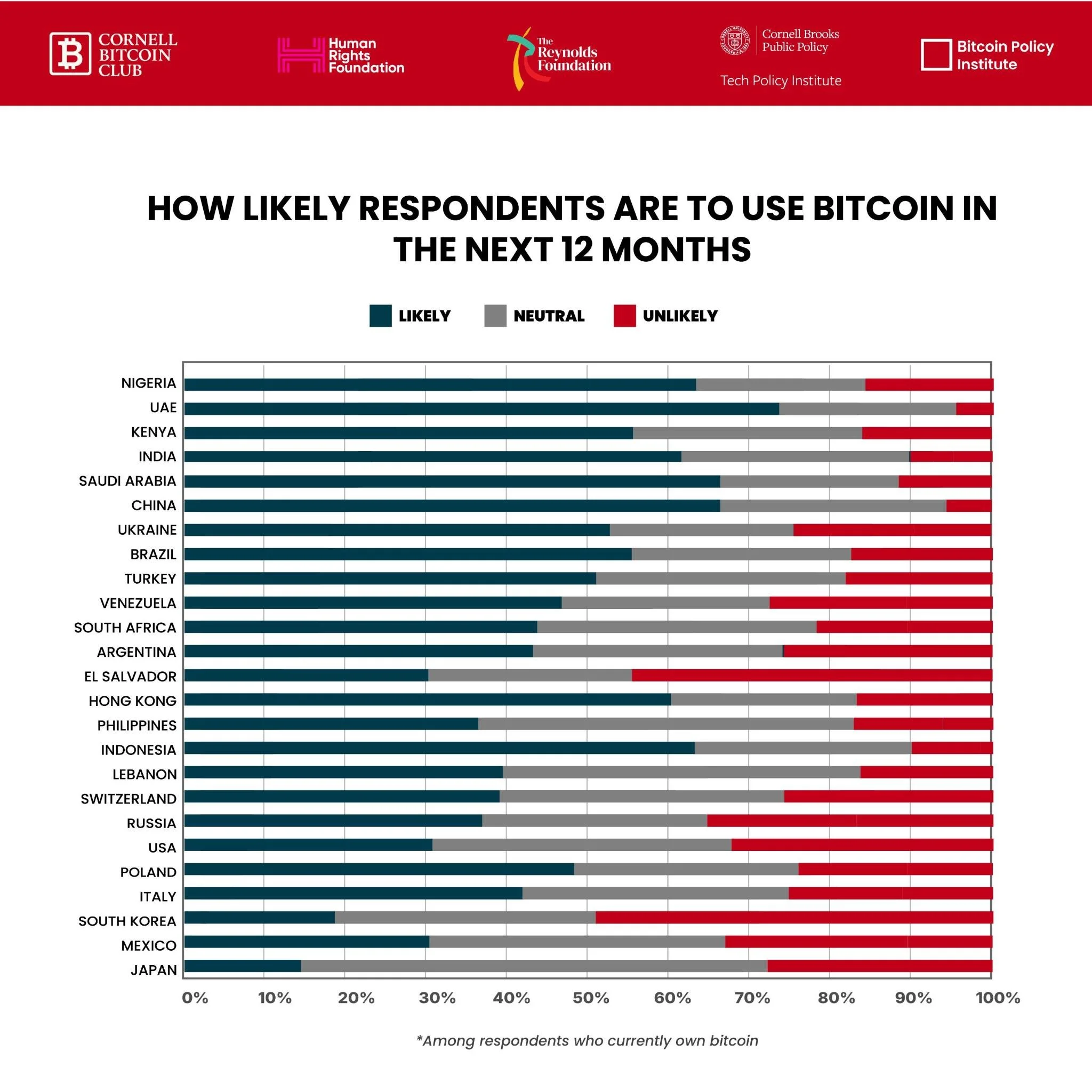

🚀 Will Bitcoin Be Used at All?

Even among current owners, intent to use bitcoin in the next year is not universal.

Most likely to use bitcoin:

🇦🇪 UAE: 73.64% “Likely” or “Very Likely”

Over 60% “Likely” or “Very Likely” in 🇨🇳 China, 🇸🇦 Saudi Arabia, 🇳🇬 Nigeria, 🇮🇩 Indonesia, 🇮🇳 India, 🇭🇰 Hong Kong

Most hesitant:

🇰🇷 South Korea (49.13%) and 🇸🇻 El Salvador (44.54%) “Unlikely” or “Very Unlikely”

🇯🇵 Japan, 🇷🇺 Russia, 🇺🇸 USA also report high rates of “Very Unlikely”

Insight: Ownership does not guarantee ongoing use—especially in environments where bitcoin adoption has been encouraged from the top down rather than emerging organically.

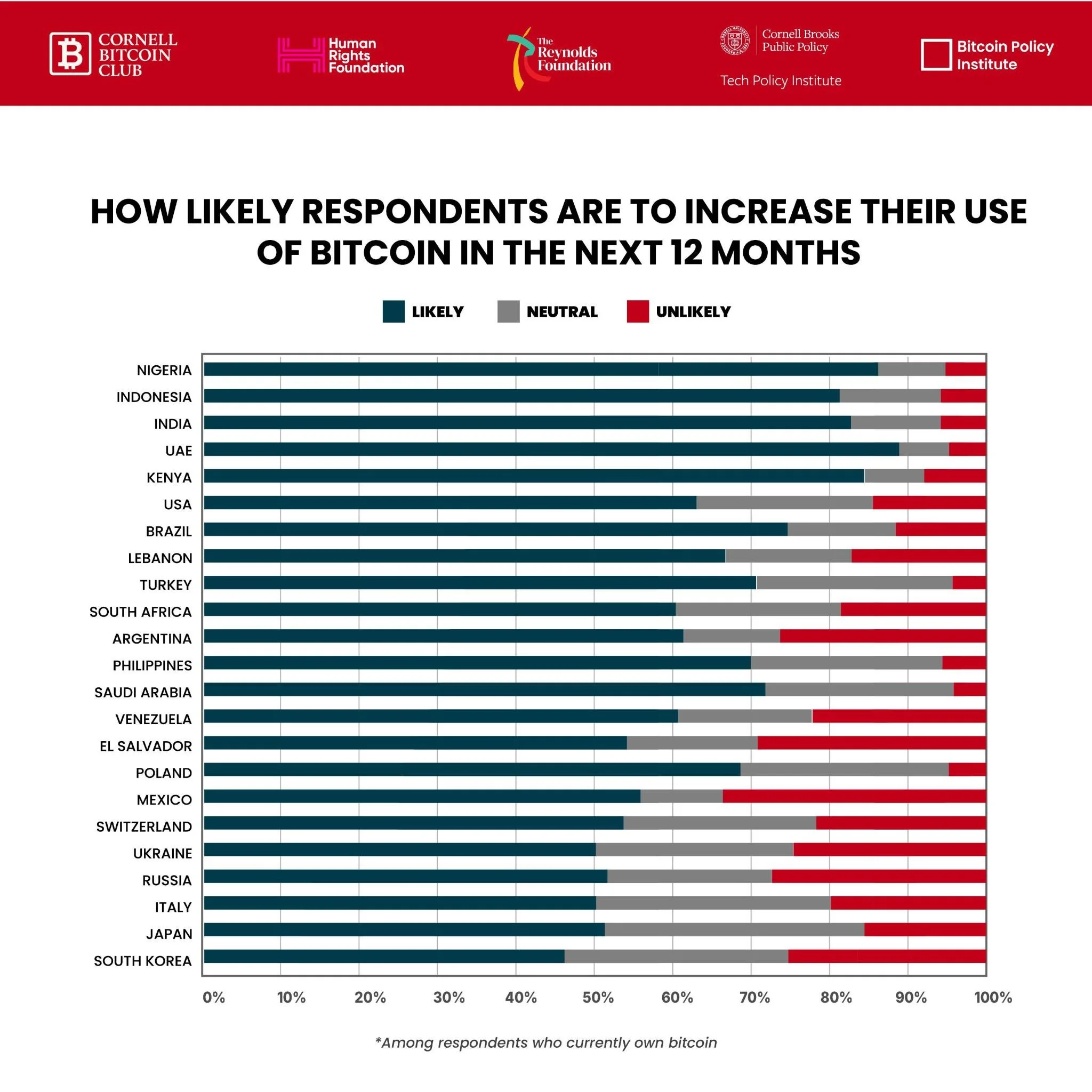

🔄 Will Bitcoin Usage Increase?

Among current holders, some countries are signaling stronger transactional intent for the next 12 months.

Most likely to increase usage:

High “Very Likely” scores: 🇳🇬 Nigeria (58.06%), 🇮🇩 Indonesia (49.82%), 🇮🇳 India (49.82%)

High “Likely” scores: 🇰🇪 Kenya (44.97%), 🇵🇱 Poland (43.05%), 🇸🇦 Saudi Arabia (41.34%)

Combined “Likely” + “Very Likely”: 🇦🇪 UAE (88.92%)

Least likely:

High “Very Unlikely” scores in 🇰🇷 South Korea (16.55%) and 🇸🇻 El Salvador (14.79%)

🇯🇵 Japan is the most neutral, with 33.08% undecided

Takeaway: Enthusiasm for future use clusters in regions of economic experimentation or instability.

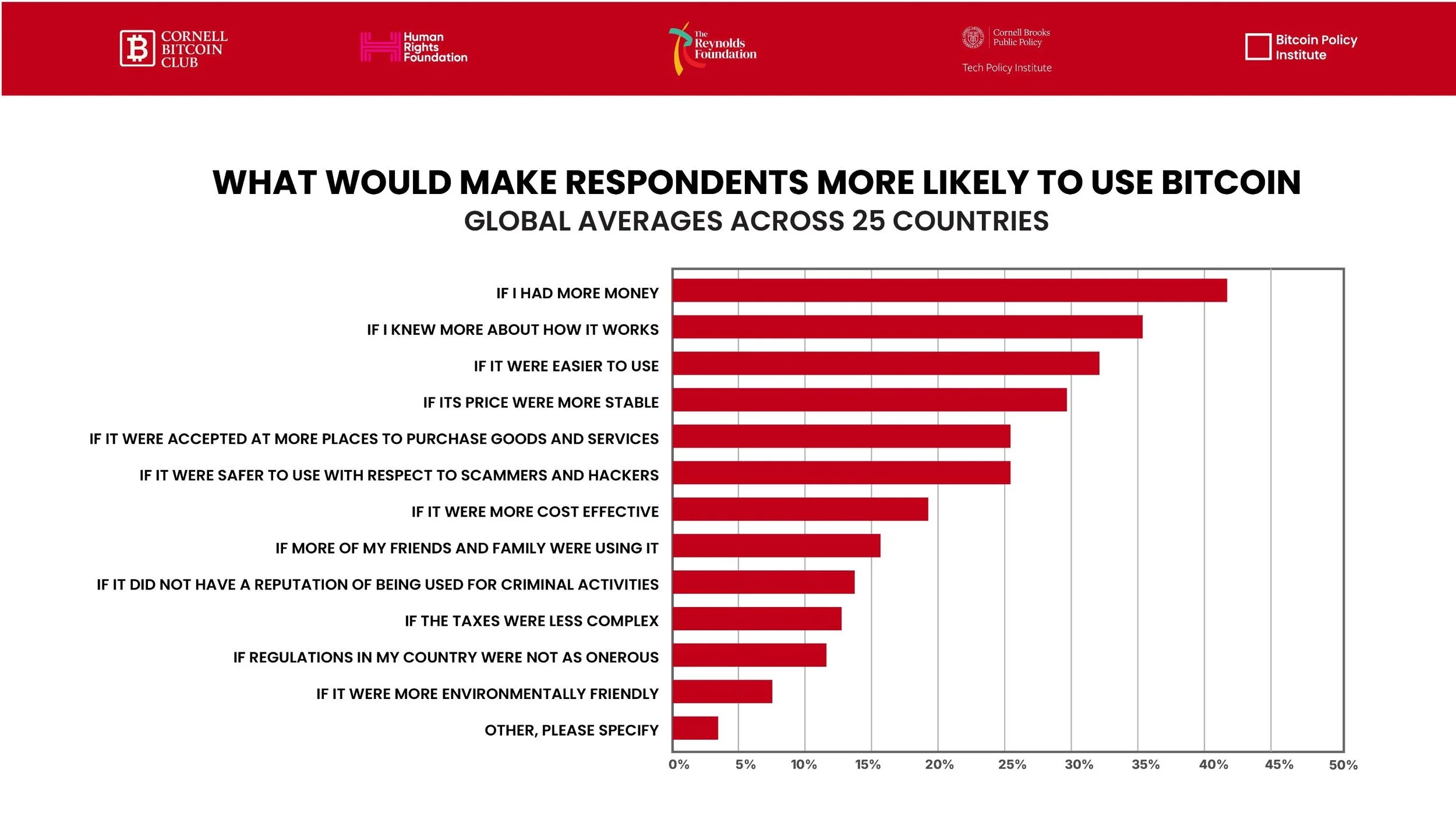

🧩 What’s Holding People Back?

Among respondents who have never owned bitcoin, the top motivators that would make them more likely to use it are practical rather than ideological.

Top motivators:

“If I had more money” (41.85%)

“If I knew more about how it works” (35.37%)

“If it were easier to use” (32.14%)

Lower-ranked concerns:

Environmental impact (7.38%)

Tax complexity (12.78%)

Association with crime (13.76%)

Takeaway: Education and usability appear to be more significant barriers than regulation, reputation, or environmental concerns.

🧭 Conclusion: Adoption Hinges on Trust, Utility, and Access

Bitcoin’s future depends not just on technology—but on perception, purpose, and practicality.

🌍 In countries facing inflation or financial instability, bitcoin is viewed as a potential lifeline.

🧠 In wealthier, more regulated markets, skepticism persists.

📈 Across the board, education, usability, and accessible financial infrastructure emerge as the most powerful levers for broader adoption.

The findings reinforce that bitcoin’s growth is not inevitable—it is contingent on trust, comprehension, and inclusion.

For policymakers, builders, and educators alike, the path forward begins with listening: What would it take for the next person to opt in?

🔮 Looking Ahead

Next week, we’ll share a summary “scorecard” of the past 10 weeks.

Until then, all our open-source research is available at: 🔗 www.cornellbitcoinclub.org