Week 10: Catalysts of Adoption

This week’s analysis concludes the 10-week data release by examining what drives and constrains bitcoin adoption across 25 countries. The findings highlight how belief in bitcoin’s potential to increase financial freedom varies widely by economic context, with stronger conviction in countries facing inflation or limited banking access. Among current owners, intent to use bitcoin in the next year differs substantially, suggesting that ownership and usage are not synonymous. Education, ease of use, and perceived utility emerge as the strongest motivators for non-owners, while skepticism persists in stable, high-income economies. Taken together, the results indicate that bitcoin adoption depends less on ideology and more on trust, usability, and access.

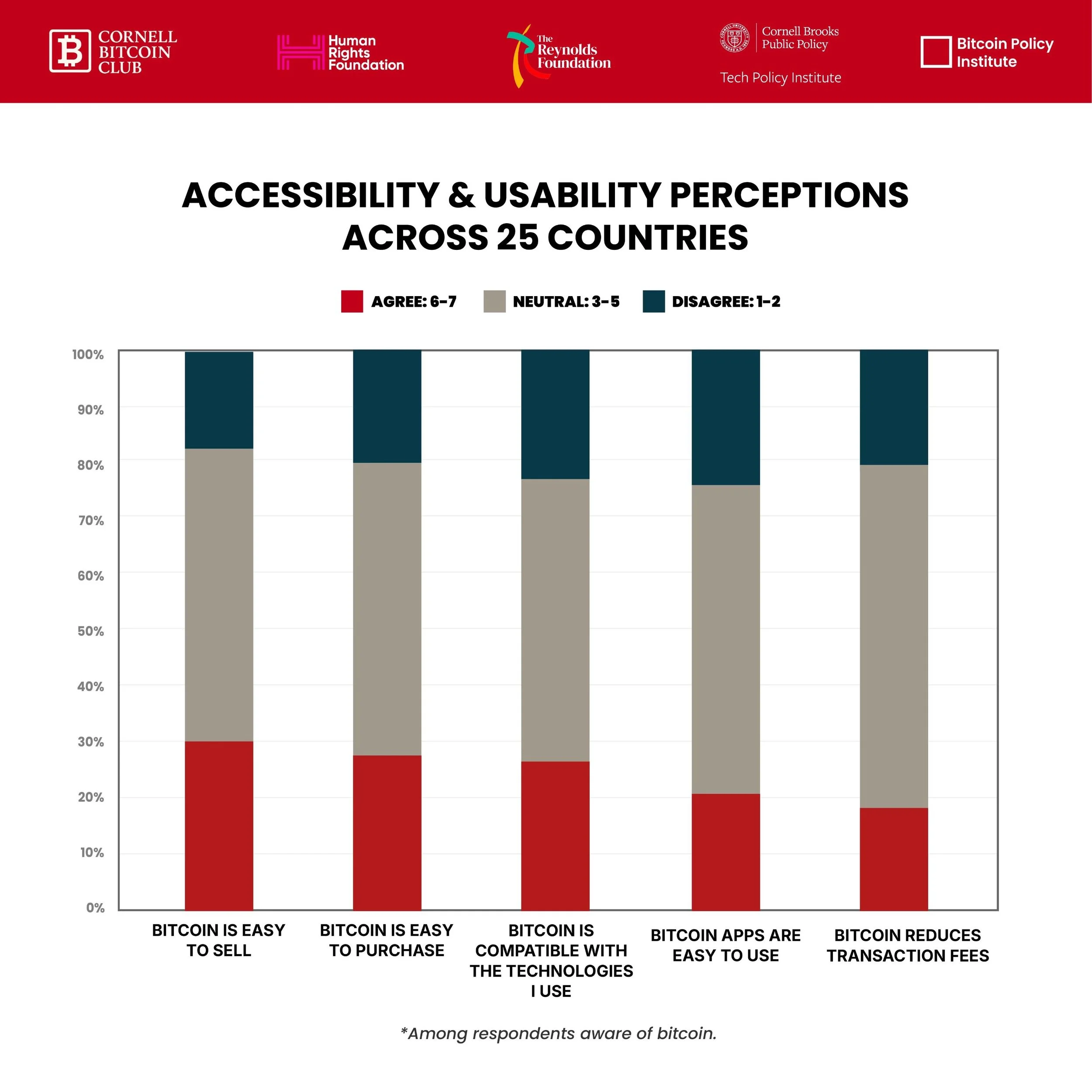

Week 9: Perceptions of Bitcoin (Part II)

This week’s analysis explores perceptions of bitcoin’s accessibility, regulation, and readiness across 25 countries. While a majority of respondents remain neutral on bitcoin’s ease of use, cost efficiency, and security, the findings reveal persistent uncertainty rather than outright skepticism. Roughly one in three respondents find bitcoin difficult to understand, and fewer than one in five feel equipped with the knowledge or resources to use it. These results suggest that education, usability improvements, and supportive on-ramps are likely to play a critical role in shaping future adoption.

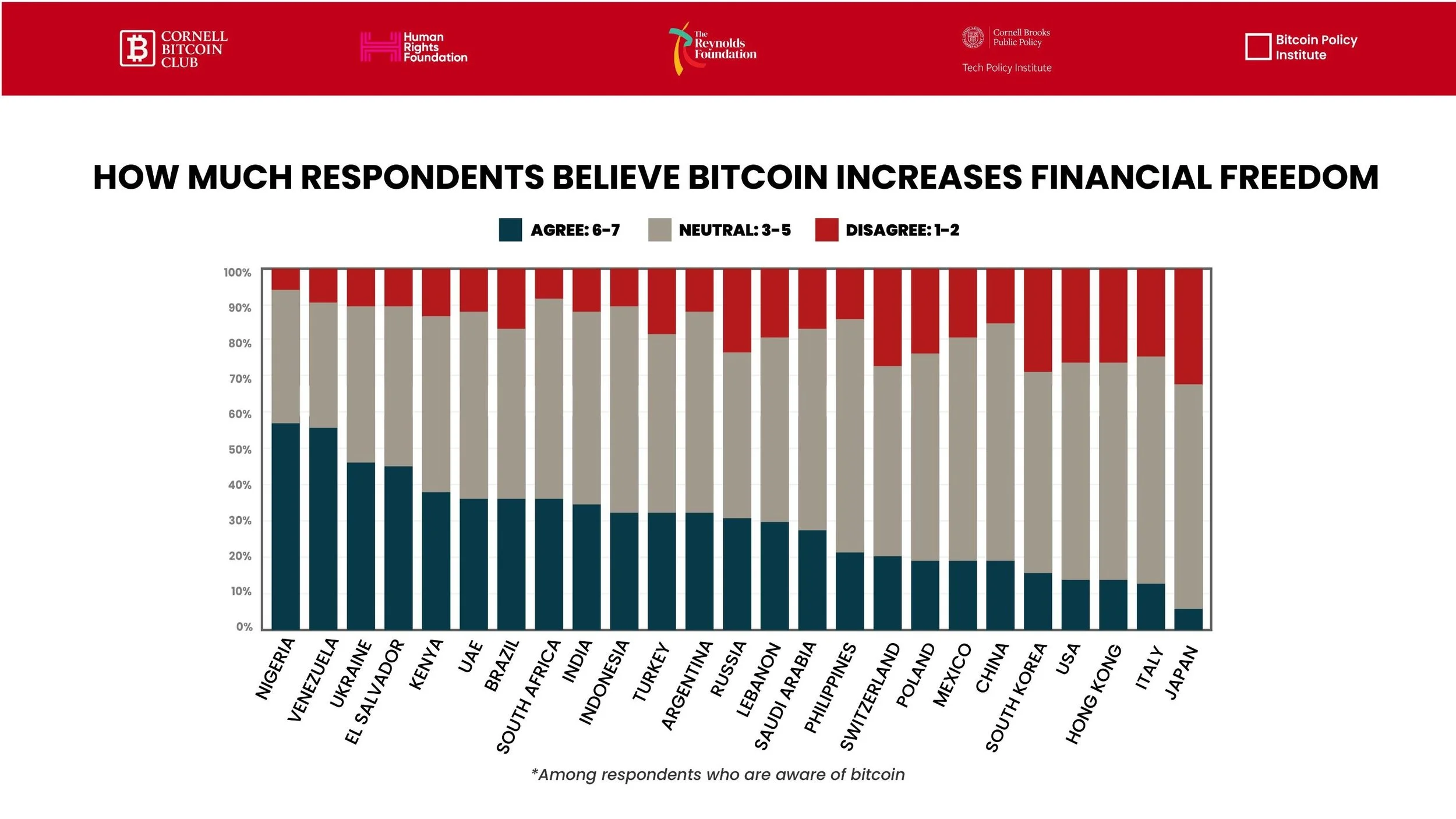

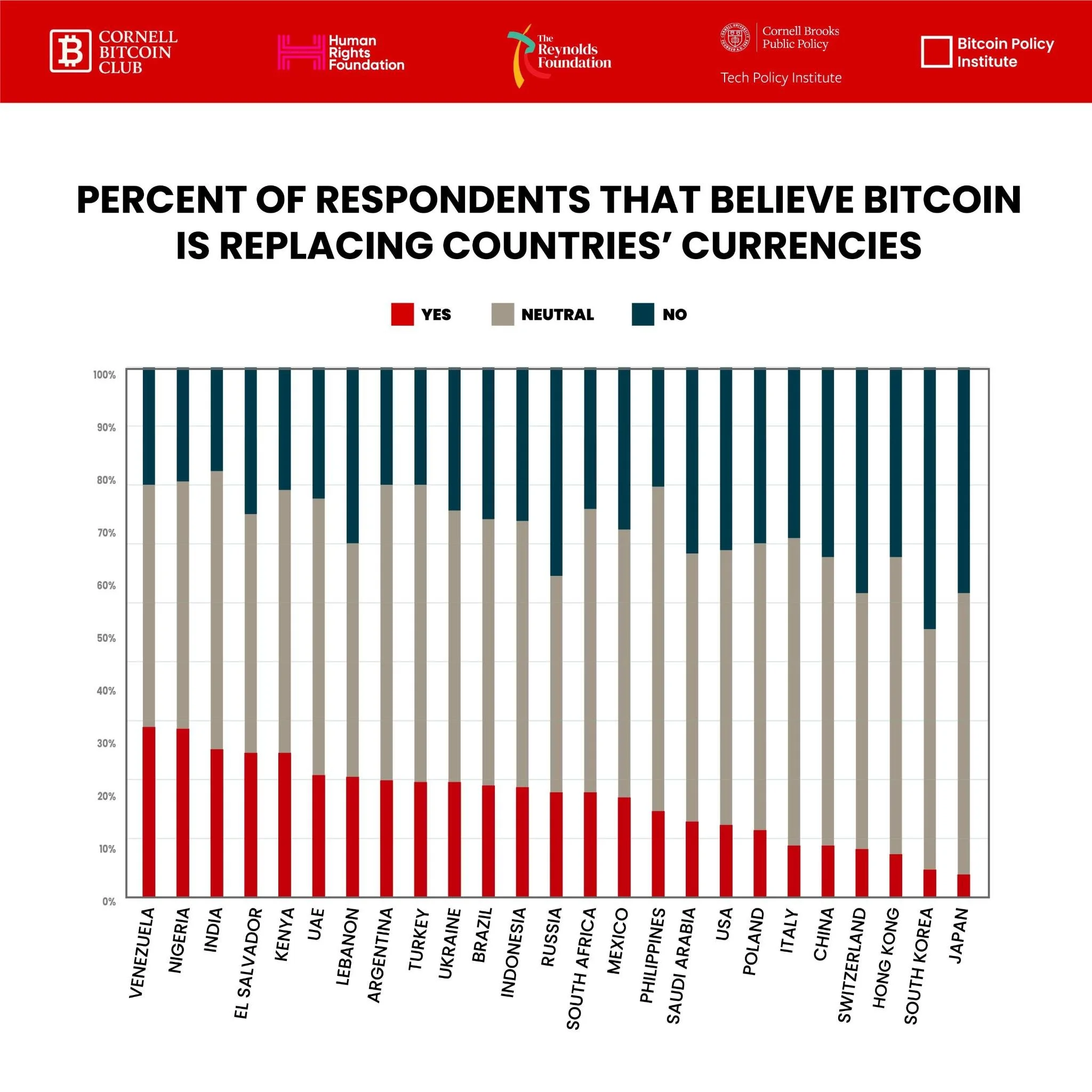

Week 8: Perceptions of Bitcoin (Part I)

This week’s analysis examines perceptions of bitcoin’s future across 25 countries. While majorities in many emerging and high-inflation economies view bitcoin as part of the monetary future, skepticism is more common in stable, high-income countries, often linked to concerns about volatility. Stablecoins are frequently seen as more plausible for everyday payments, suggesting demand for digital dollars as an intermediate step. These findings highlight that perceptions of bitcoin’s role are shaped less by uniform consensus and more by local economic and cultural context.

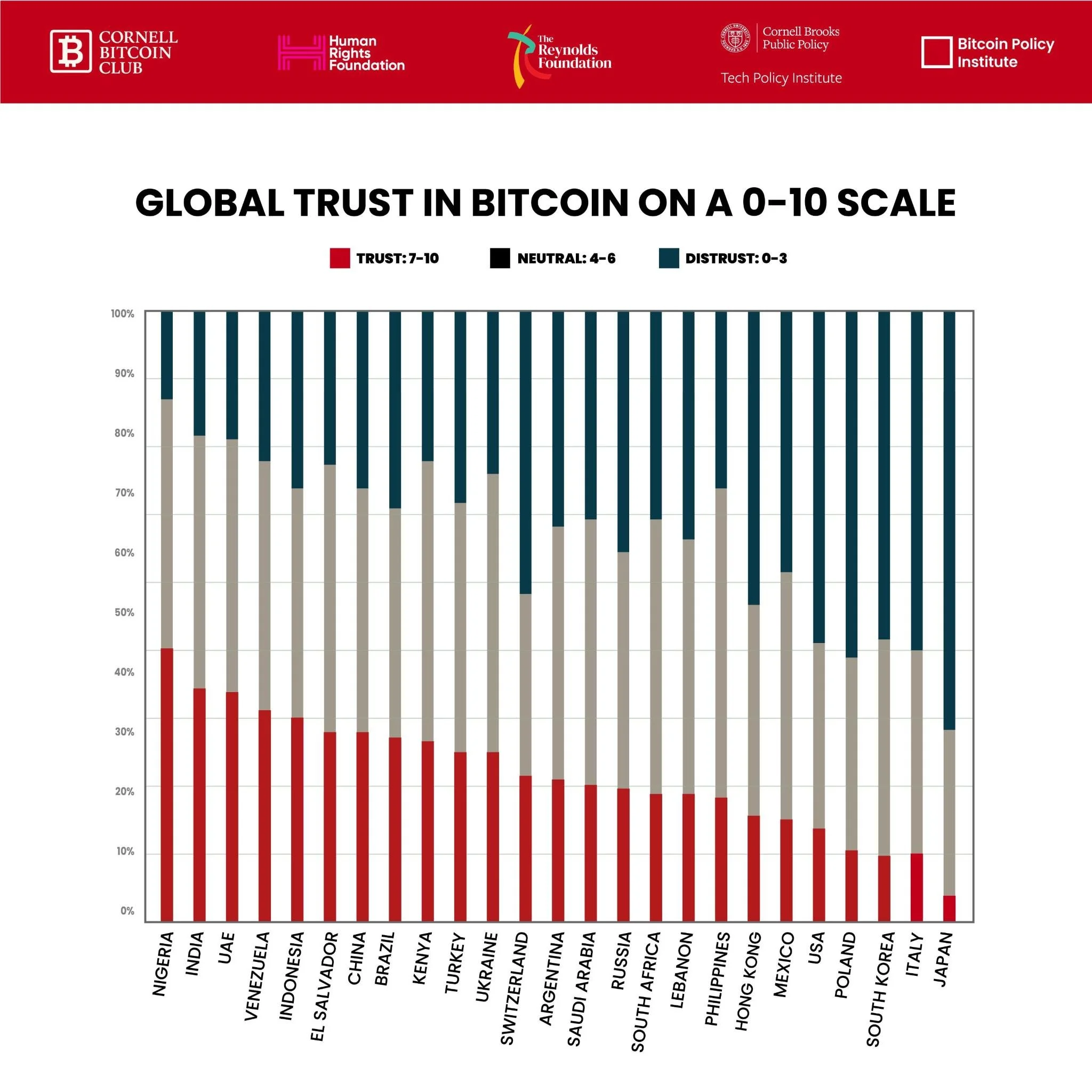

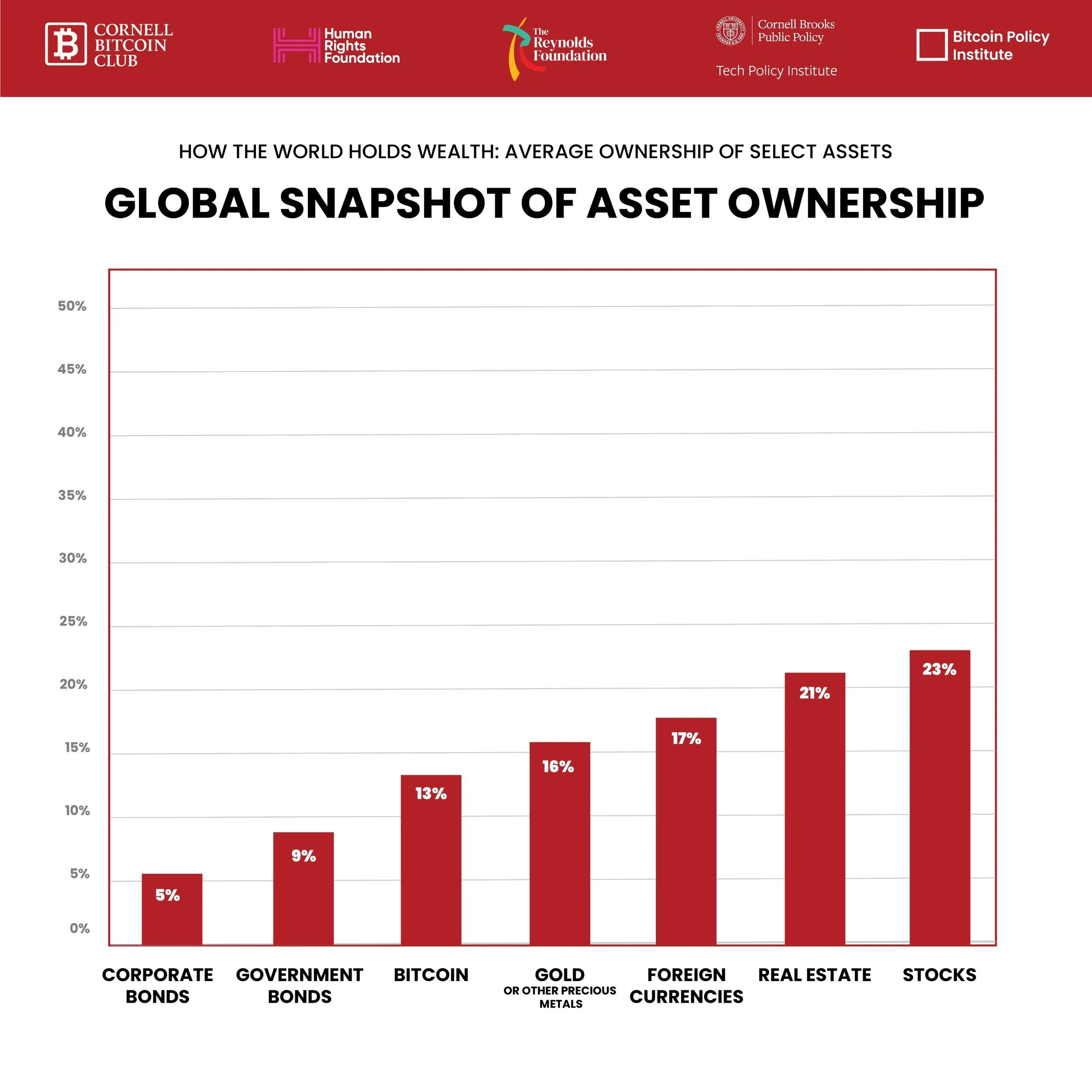

Week 7: Trust & Risk: How Bitcoin Stacks Up

This week’s analysis examines global perceptions of trust and risk across 25 countries. On average, respondents rated their trust in Bitcoin at 4.67/10—below traditional assets such as gold, real estate, and national currencies. While bitcoin surpasses trust in government in 10 countries, it continues to be widely perceived as high risk. Responses to questions on fraud, privacy, and service providers were dominated by uncertainty, and higher financial stress often coincides with higher reported ownership and trust. These findings suggest bitcoin’s position is shaped less by uniform acceptance or rejection and more by uncertainty, comparative trust, and local economic context.

Week 6: Stablecoins

This week’s analysis examines stablecoin adoption across 25 countries, comparing awareness, knowledge, and use cases alongside bitcoin. While stablecoins like USDT, USDC, and BUSD provide access to dollars, stability, and cross-border payments, they remain custodial and tied to fiat debasement. Findings highlight that stablecoins function as short-term tools for stability, whereas bitcoin remains distinct as decentralized, censorship-resistant, and a pathway to long-term financial sovereignty.

Week 5: Barriers to Bitcoin Adoption

This week’s analysis examines barriers to bitcoin adoption across 25 countries. While public discourse often cites environmental impact, criminal use, or complexity, our data shows that the most common obstacles are lack of interest, financial constraints, and security concerns—factors that are often situational or addressable. These findings suggest that adoption challenges are less about rejection and more about opportunity, shaped by design, education, and access.

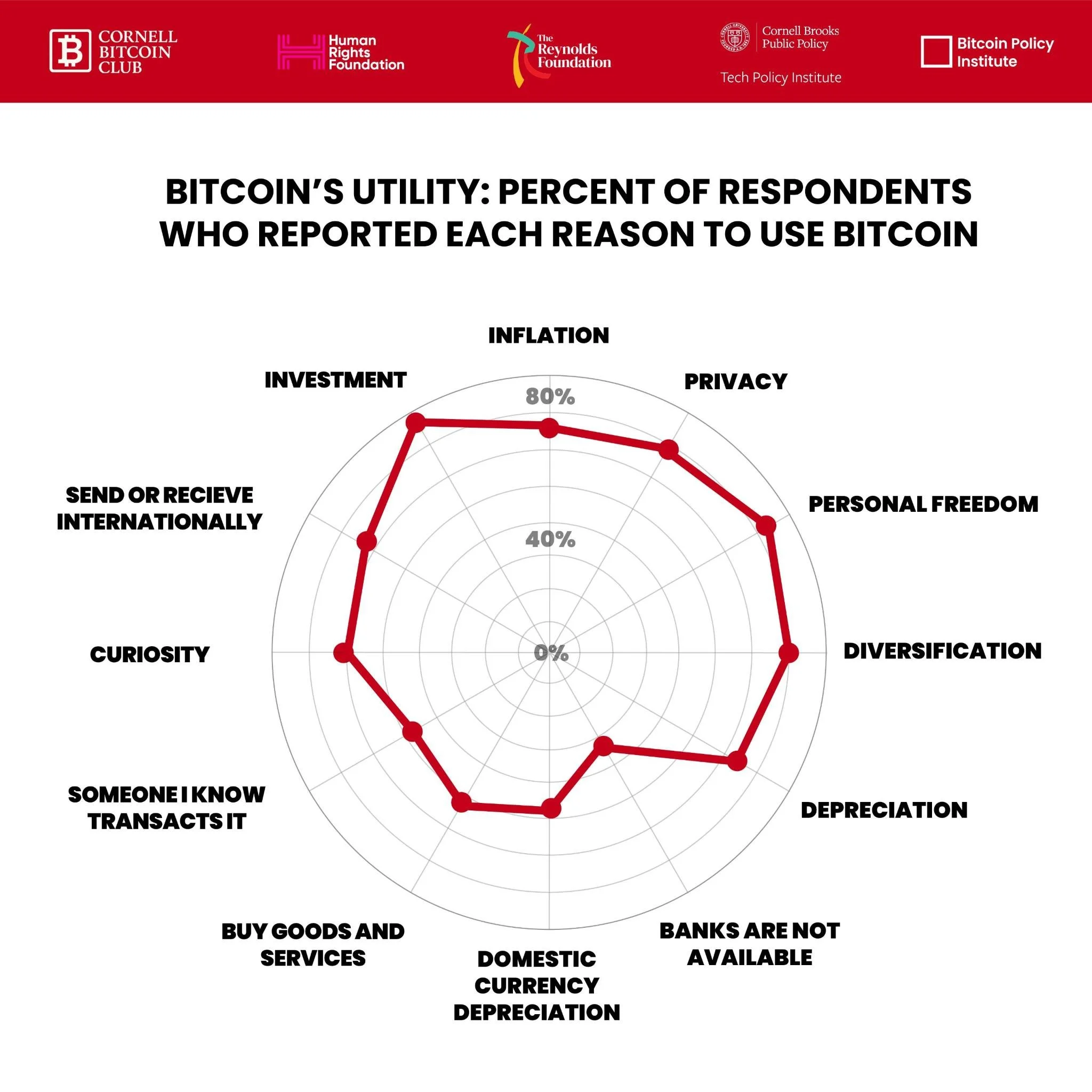

Week 4: How Do People Use Bitcoin? (Part II)

This week’s analysis explores the motivations behind bitcoin adoption across 25 countries. While investment is the most common driver, diverse reasons such as personal freedom, inflation hedging, remittances, and curiosity reveal how bitcoin reflects distinct economic and cultural contexts.

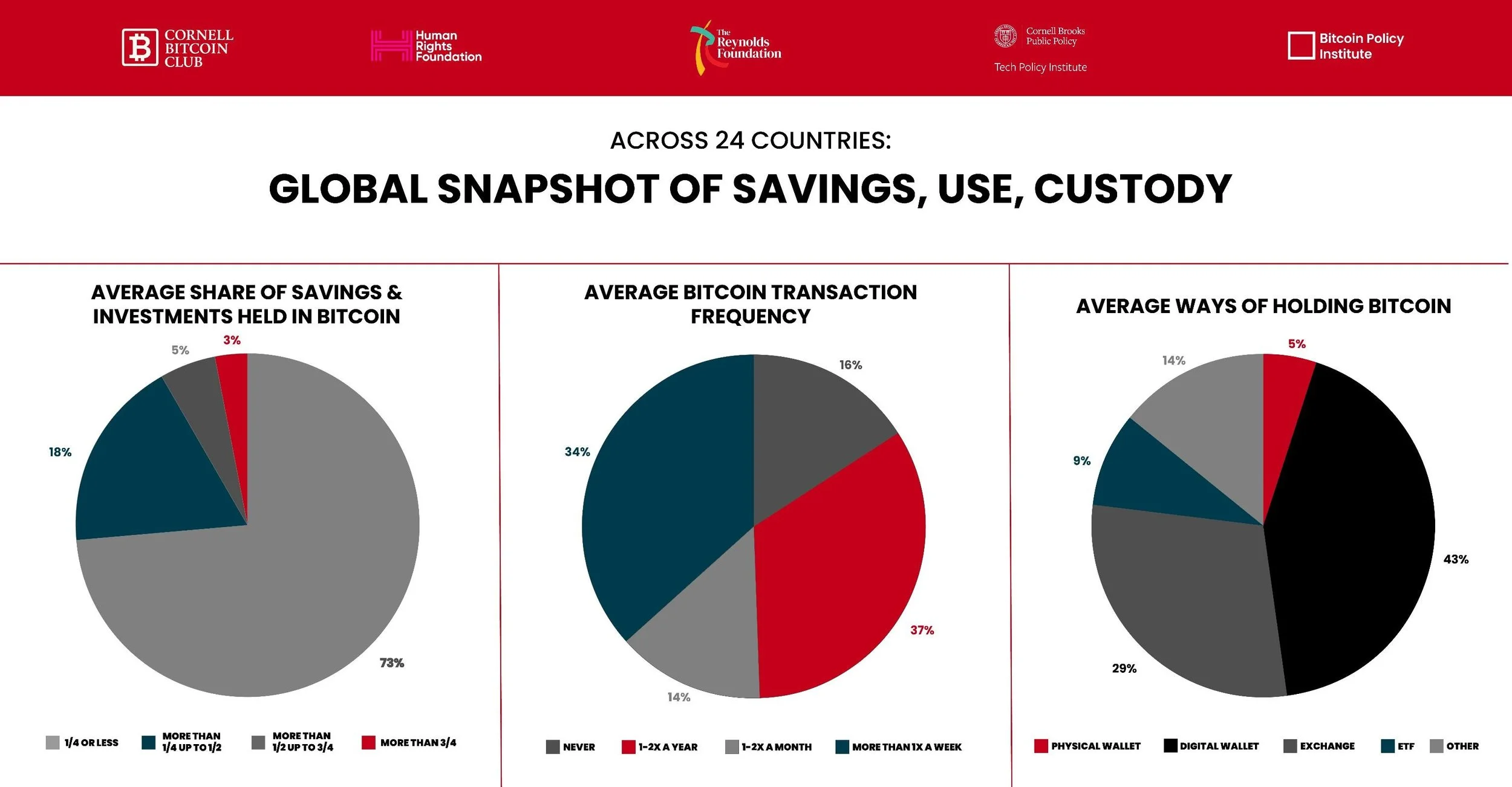

Week 3: How Do People Use and Hold Bitcoin? (Part 1)

This week’s analysis examines how individuals across 24 countries use bitcoin—for saving and spending—and custody methods. While usage patterns vary by context, the data reveals that bitcoin functions as both a store of value and a medium of exchange, shaped by trust, regulation, and economic conditions.

Week 2: Who Actually Owns Bitcoin?

This week’s analysis explores who owns Bitcoin across 25 countries, revealing how adoption is shaped by gender, age, income, employment status, and institutional trust. While Bitcoin is accessible to all, ownership patterns show it is far from evenly distributed.

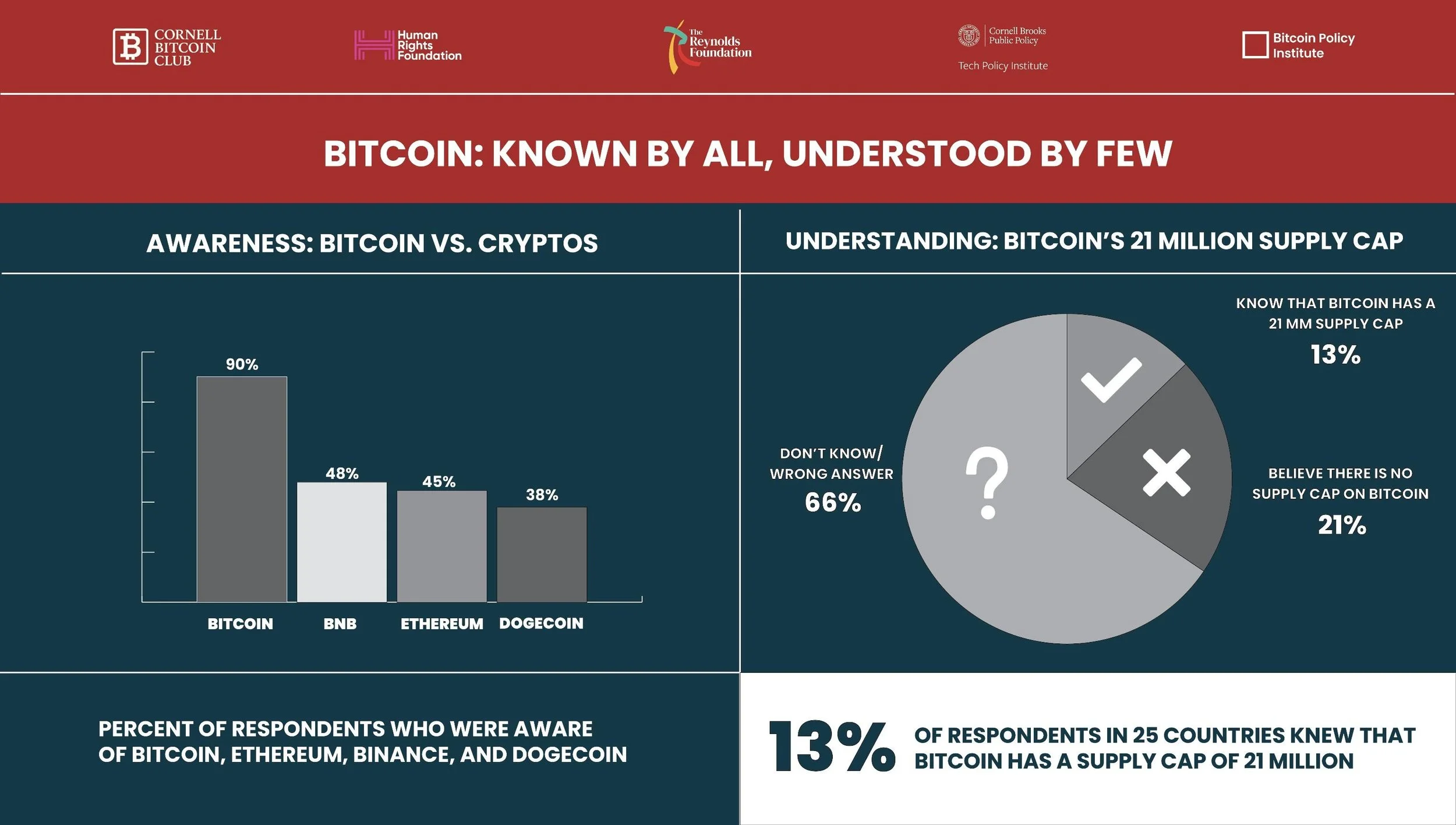

Week 1: Bitcoin—Known by All, Understood by Few

While global awareness of Bitcoin is high, meaningful understanding of its fundamental properties remains limited. This week examines the distinction between awareness, perceived knowledge, and actual comprehension across 25 countries.

Week 0: Setting the Stage

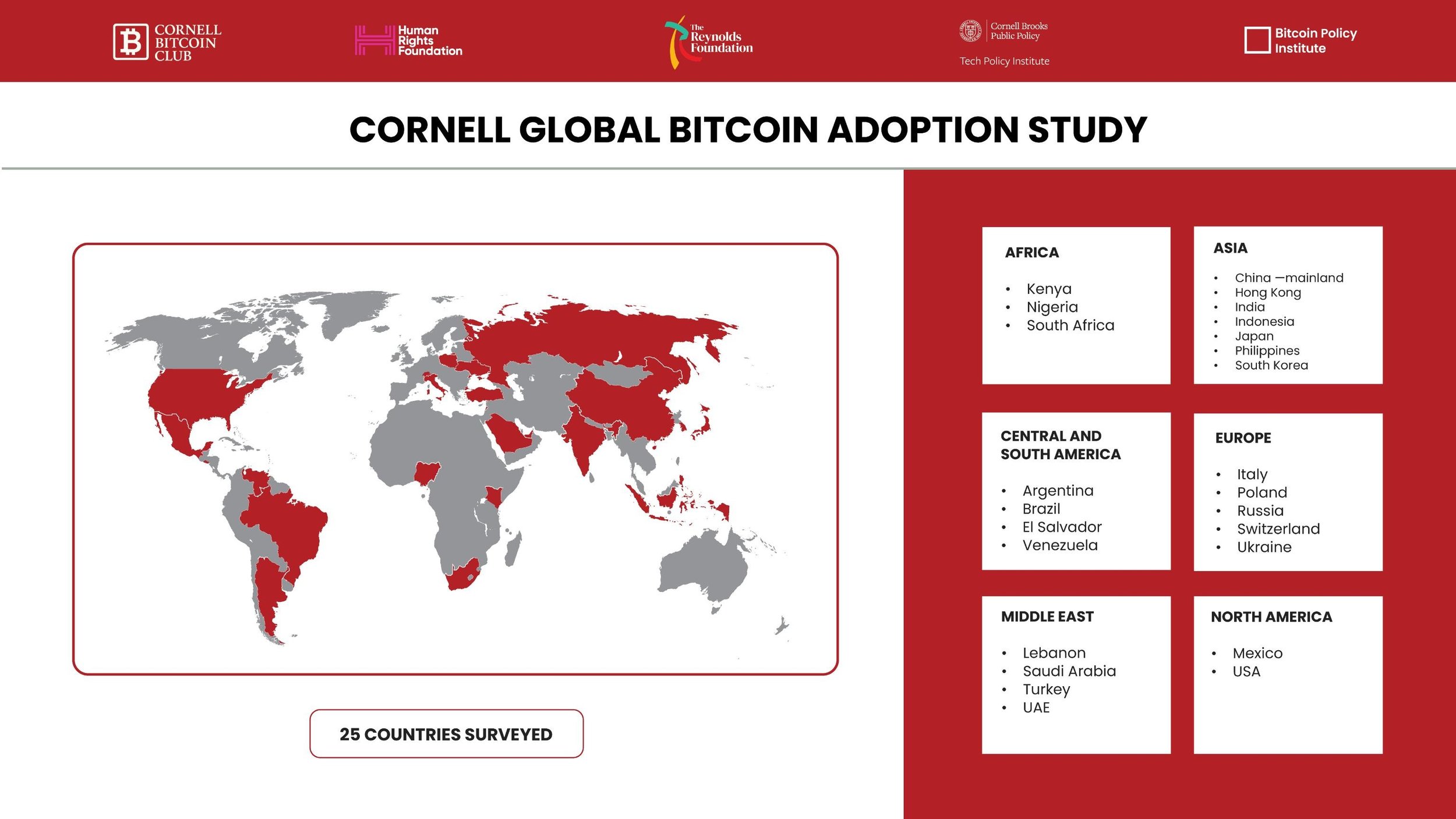

Over the next 10 weeks, we’re releasing findings from one of the most comprehensive global studies ever conducted on Bitcoin and financial freedom supported by The Human Rights Foundation and The Reynolds Foundation.