Week 6: Stablecoins

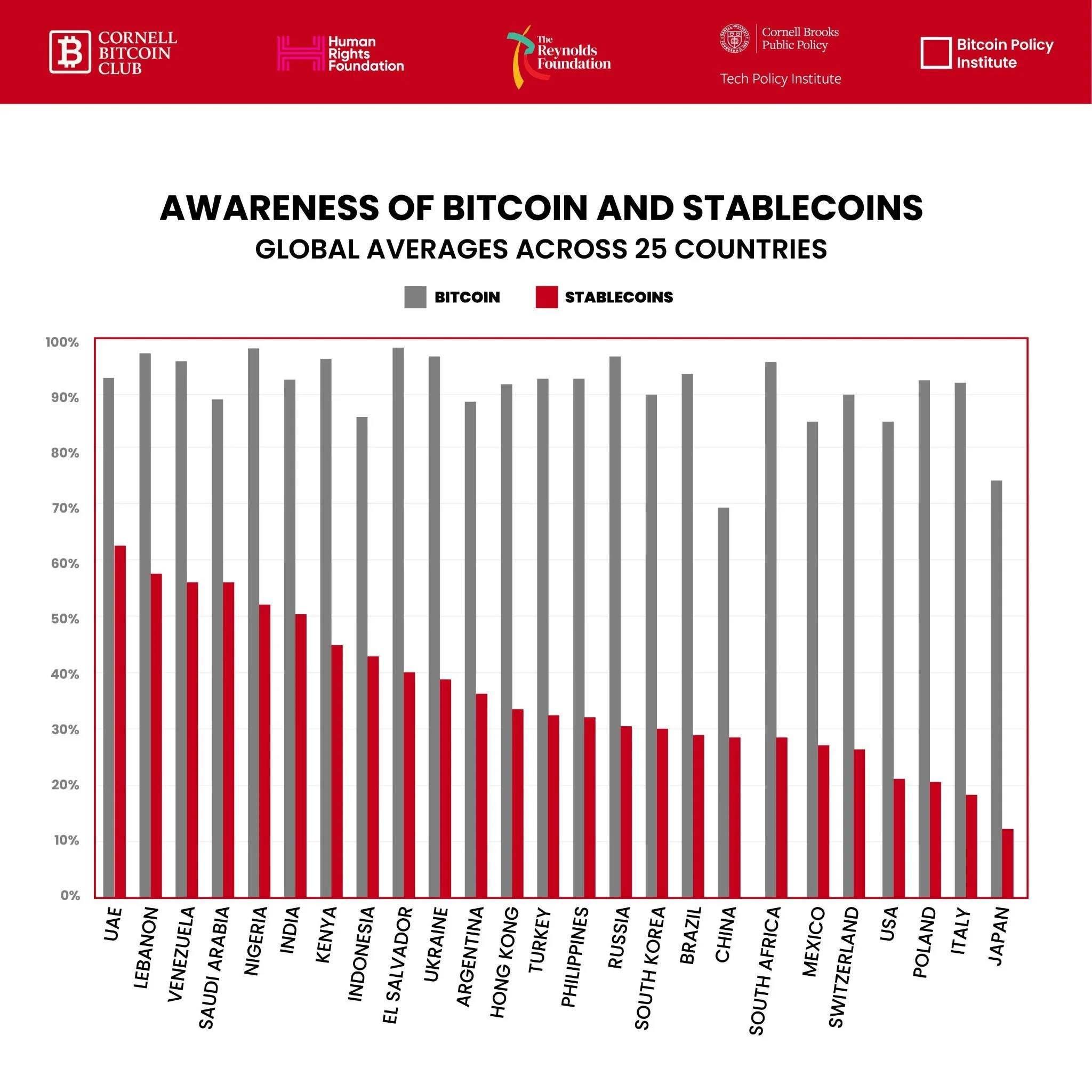

Bitcoin is one of the most recognized words on the planet. Across 25 countries in our study, awareness averaged 90%.

Stablecoins? Just 34%.

And yet, stablecoins like Binance’s BUSD, Tether’s USDT, and Circle’s USDC have become tools of survival, remittance, and savings.

So:

Who’s using them?

Why do they matter?

And what do they fail to solve?

This week, we compare bitcoin and stablecoins across 25 countries to uncover what people are reaching for—and what they’re searching for.

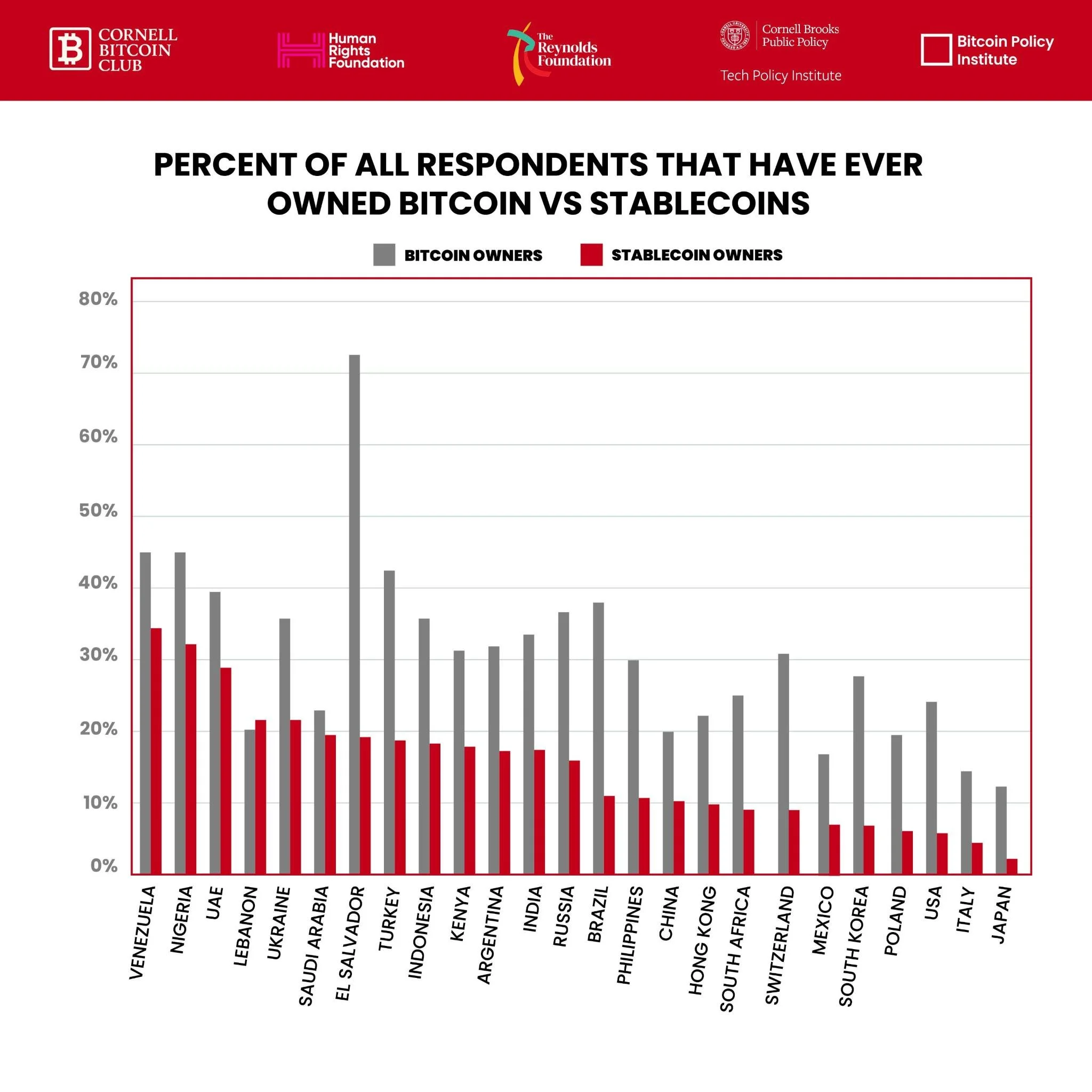

🌐 Bitcoin vs. Stablecoin Ownership

Bitcoin still outpaces stablecoins in global ownership, but stablecoins are carving out their own niche in very specific contexts:

Venezuela and Nigeria: High ownership reflects domestic economic instability, inflation, and the search for dollar access.

Japan and Italy: With relatively stable national currencies (yen and euro), demand for USD-pegged stablecoins is low.

Ukraine: Ownership surged as people sought stability amid conflict and the breakdown of banking rails.

Stablecoins are less about speculation. They’re about accessing dollars in places where dollars are hard to reach.

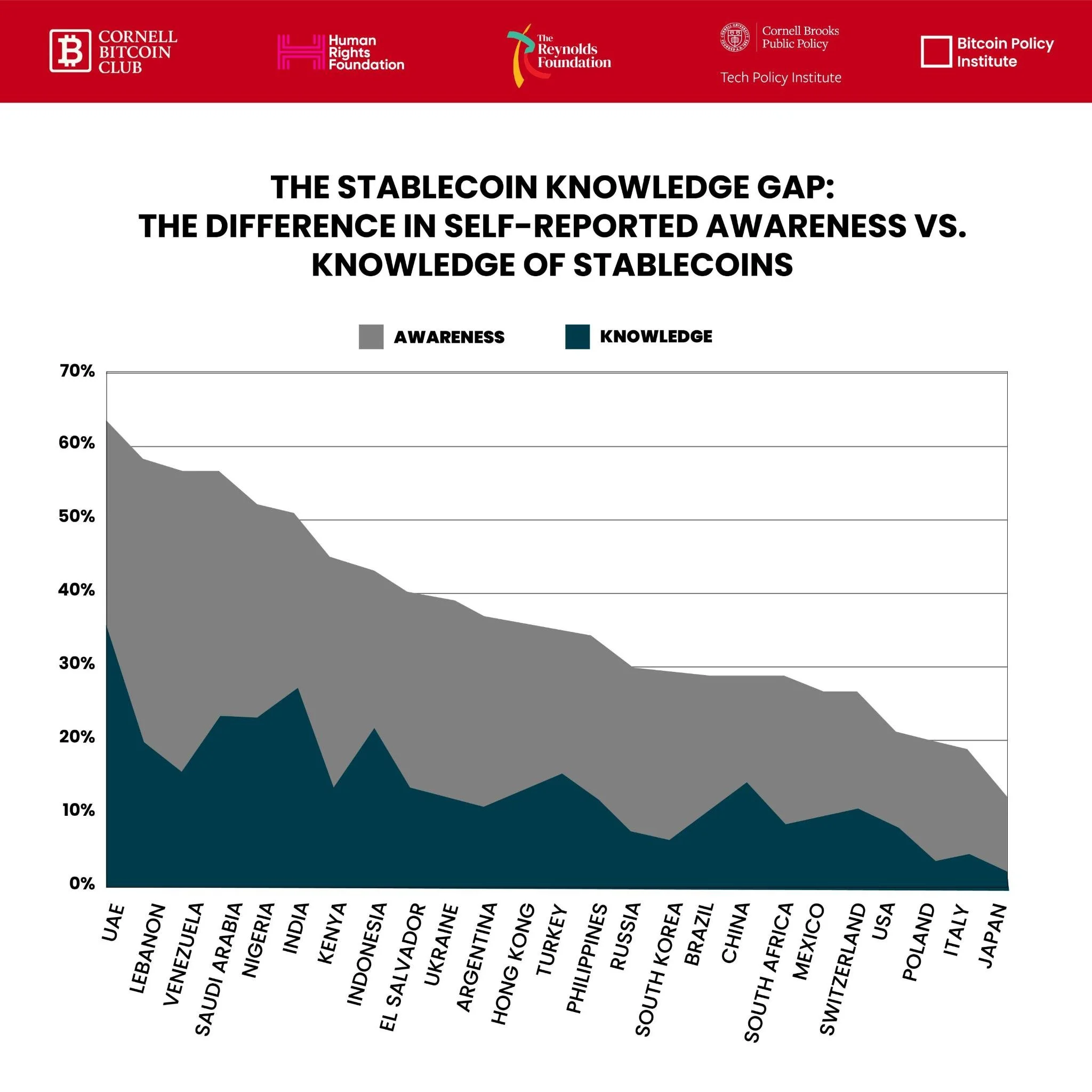

📕 The Knowledge Gap

Awareness of stablecoins is one thing. Understanding them is another.

Across countries, the average gap between awareness and knowledge was 22%.

Venezuela: 40% gap

Lebanon: 37% gap

Saudi Arabia: 32% gap

In other words, even in countries where stablecoins are widely recognized, few people feel confident they understand them.

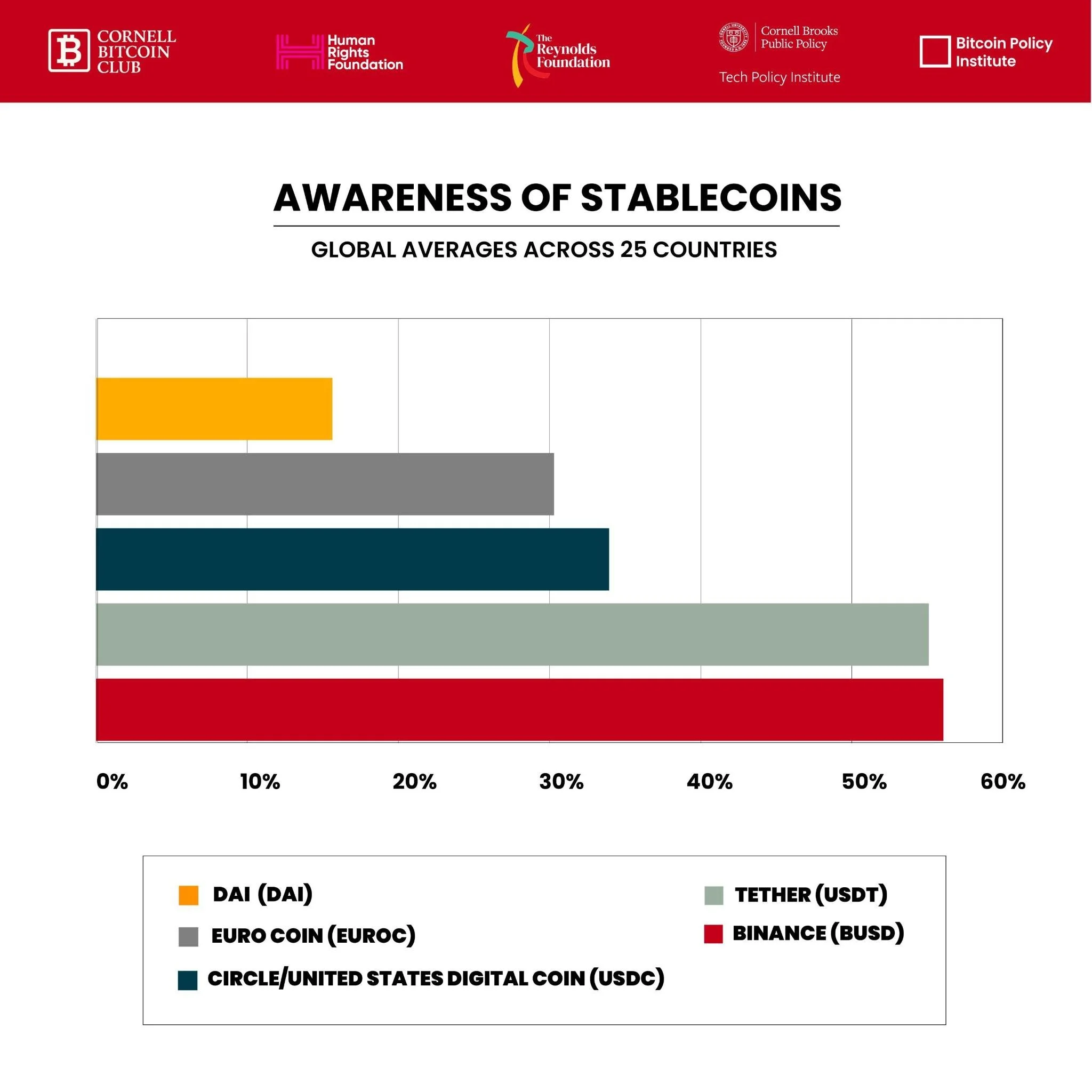

📊 The Stablecoin Market

In our study, recognition of stablecoin brands clustered around a few leaders:

Binance (BUSD) and Tether (USDT) both above 55%

Circle (USDC) and Euro Coin in the 30%+ range

Dai rounding out the top five

But critically: none of today’s leading stablecoins run on Bitcoin’s network.

That changes with the January 2025 announcement from Tether and Lightning Labs: USDT is coming to Bitcoin via the Taproot Assets protocol, combining Bitcoin’s resilience with Lightning’s speed and scalability.

⚖️ Stability, Reliability, and “The Big Four”

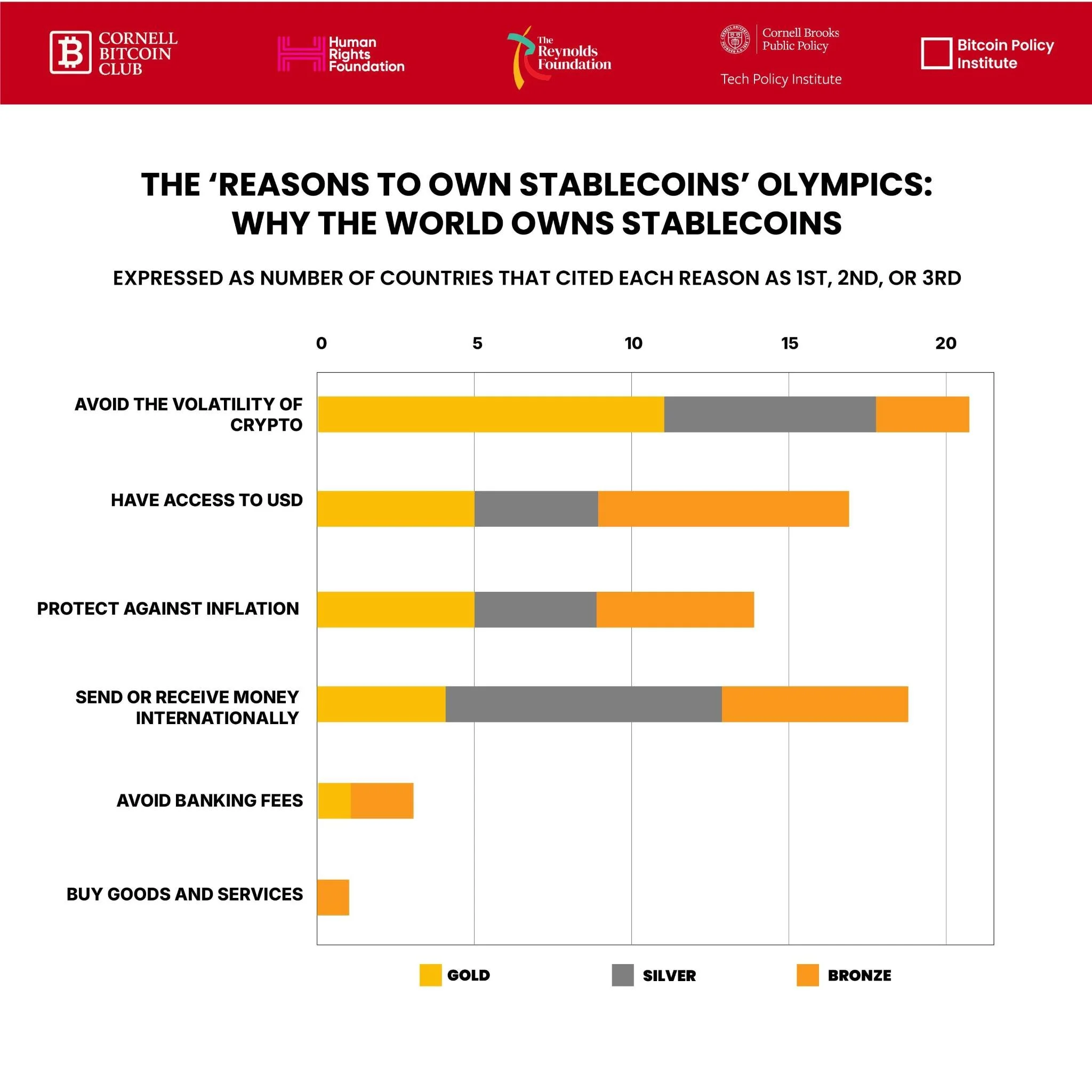

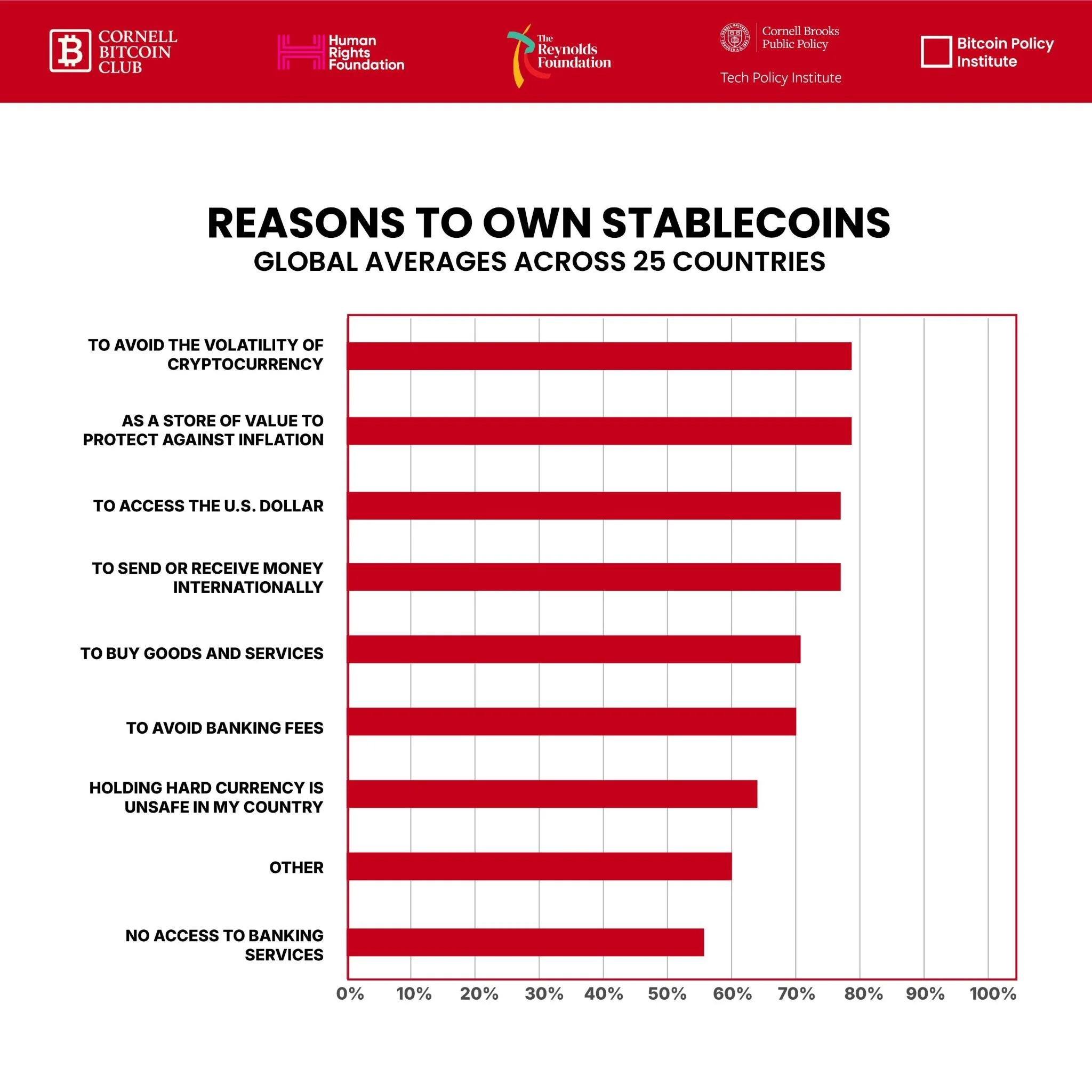

What drives people toward stablecoins?

The top two reasons globally were:

Avoiding crypto volatility

Accessing USD

Two more reasons consistently ranked close behind:

3. Protecting against inflation

4. Sending/receiving money internationally

Together, these form “the big four”—the clearest motivations to own stablecoins.

🧑🤝🧑 Individuals and 🏛️ Governments

At the individual level, stablecoins make it easier to:

Access offshore currencies

Seek stability

Hold something familiar

Our data shows the pattern clearly: people want dollars to hedge inflation and preserve value. Without direct access, they turn to stablecoins.

But as hybrids, stablecoins inherit the flaws of both fiat and crypto. They rely on custodians and banks. They can be frozen or censored. They remain tied to fiat debasement.

Bitcoin is different. The top reasons people own it are investment and personal freedom. Yet volatility, fraud, and complexity still hold many back.

At the government level, the U.S. GENIUS Act (taking effect in 2027) will accelerate stablecoin growth by:

Standardizing permitted issuers

Reinforcing the dollar’s reserve status

Expanding U.S. financial security

For 50 years, the petrodollar created demand for Treasuries at the state level. Stablecoins may now represent a new, bottom-up channel of dollar demand—driven by individuals.

🔮 Looking Ahead

Our study highlights how people reach for different tools depending on the type of financial freedom they seek.

Today: Stablecoins are bridges—offering stability, USD access, and cross-border movement.

Tomorrow: Under frameworks like the GENIUS Act, they may expand the dollar’s global role, creating new demand for Treasuries from the ground up.

The Long Run: Bitcoin stands apart—decentralized, censorship-resistant, and free from intermediaries. Where stablecoins offer familiarity in the short term, bitcoin offers sovereignty in the long term.

Stablecoins may widen access to the dollar. But bitcoin remains the only path to lasting financial freedom.

Until then, all our open-source research is available at: 🔗 www.cornellbitcoinclub.org