Week 7: Trust & Risk: How Bitcoin Stacks Up

What do people trust, what do they distrust—and where does Bitcoin fit in?

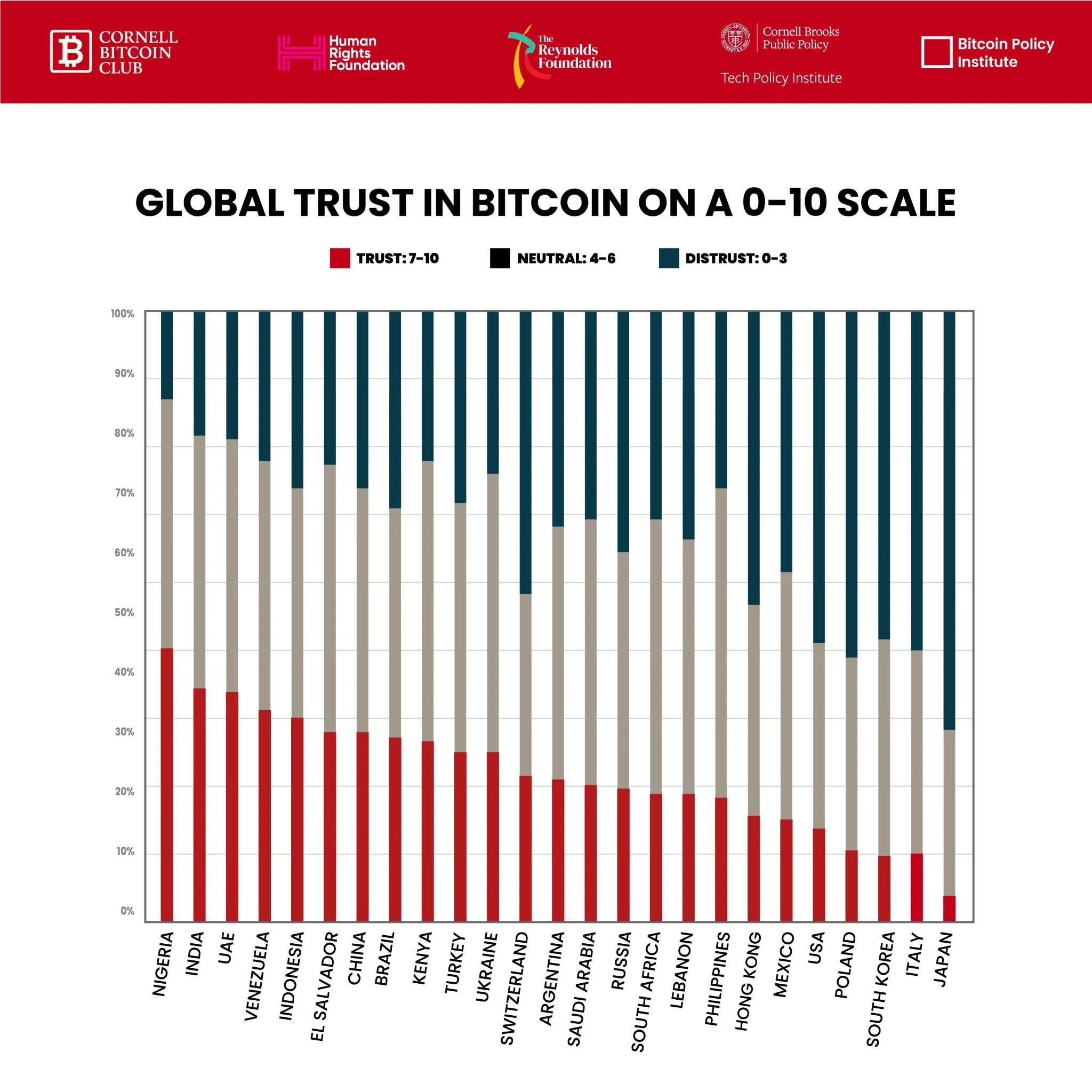

In our survey of 25,000 respondents across 25 countries, participants rated their trust in governments, currencies, banks, and Bitcoin on a scale of 0–10, where 0 means “no trust at all” and 10 means “a great deal of trust.”

Globally, Bitcoin scored an average of 4.67/10.

So how does that compare—and why does it matter?

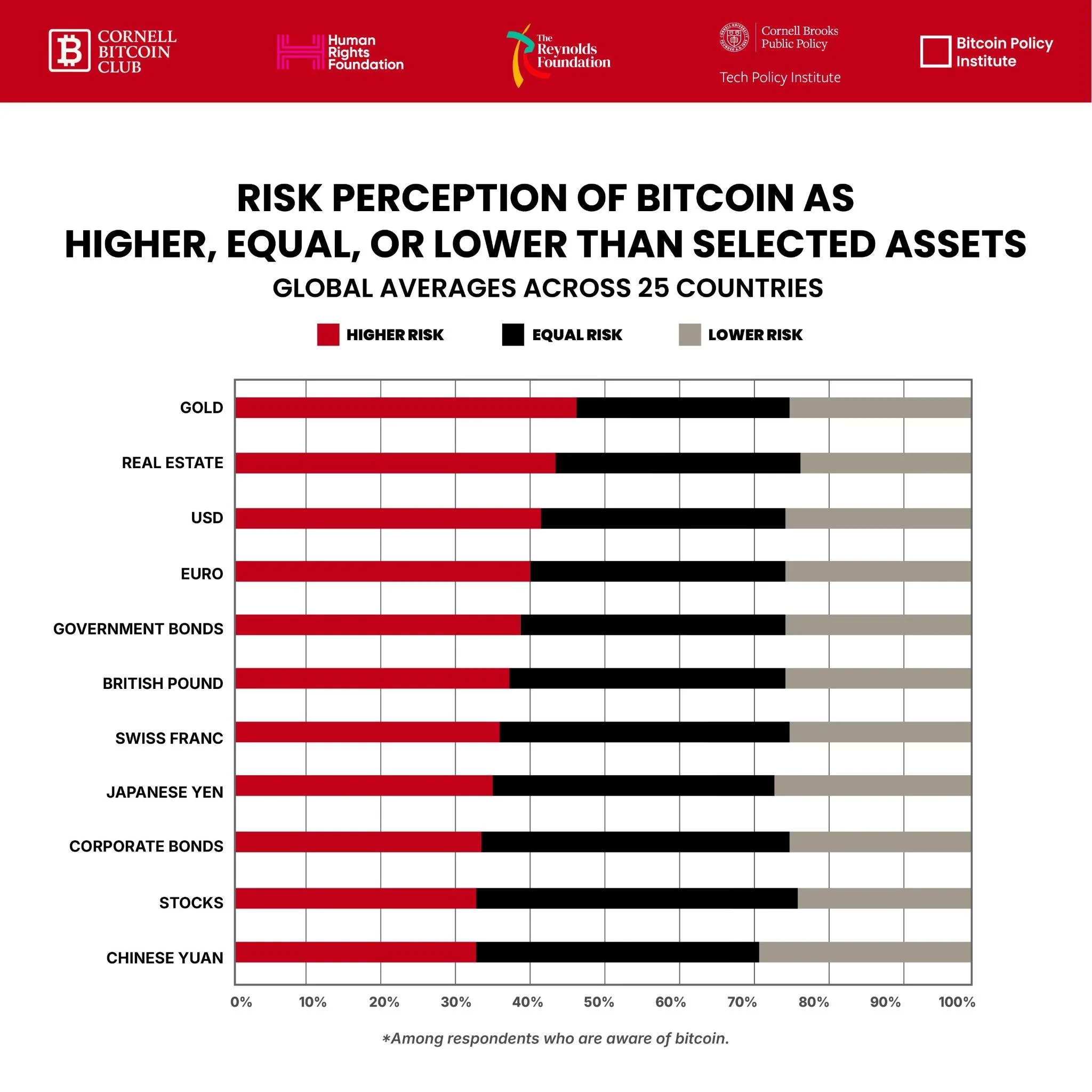

📊 Bitcoin’s Risk Profile

Even where trust is relatively higher, perceptions of risk remain a major barrier to adoption. Compared to traditional assets, respondents see Bitcoin as:

Riskier than all listed options overall

Especially riskier than gold, real estate, and the US dollar

However, 45% and 43% of respondents said Bitcoin carries equal risk to stocks and corporate bonds, respectively

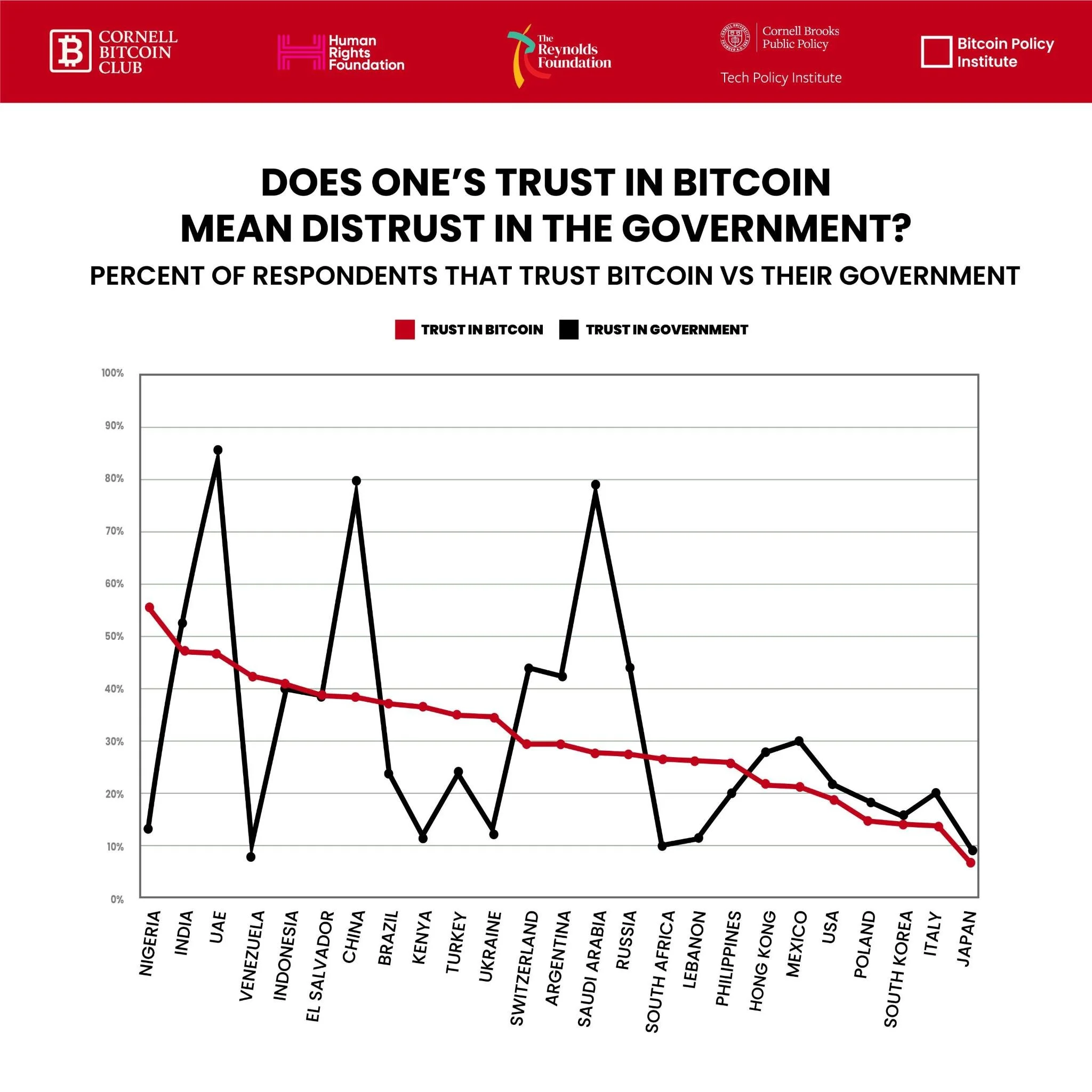

🏛 Trust in Bitcoin vs. Government

In 10 of 25 countries, people reported trusting bitcoin more than their government.

🇧🇷 Brazil, 🇮🇩 Indonesia, 🇰🇪 Kenya, 🇱🇧 Lebanon, 🇳🇬 Nigeria, 🇵🇭 Philippines, 🇿🇦 South Africa, 🇹🇷 Turkey 🇺🇦 Ukraine, & 🇻🇪 Venezuela.

The 🇦🇪 UAE, 🇨🇳 China, & 🇸🇦 Saudi Arabia are outliers with very high levels of trust in the government.

Where institutional trust is eroded, bitcoin positions itself as an alternative to centralized authority. Where there is distrust inward, eyes begin to turn outward.

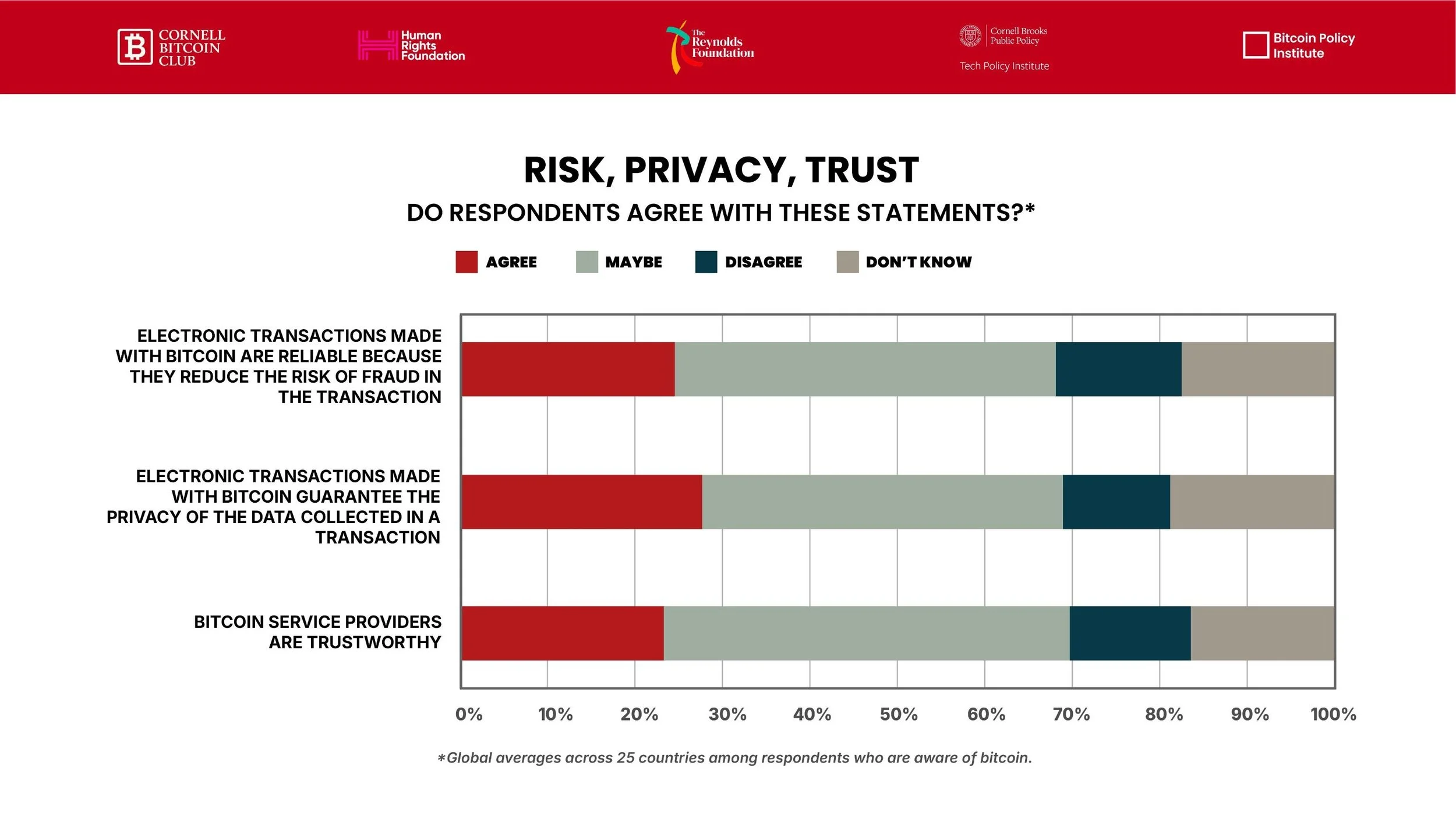

🔐 Risk, Privacy & Trust

In Week 1, we highlighted the gap between bitcoin awareness, knowledge, and understanding:

✅ Awareness is high

🤔 Knowledge is uneven

📉 Understanding is low

Those patterns reappear here.

When asked whether Bitcoin reduces fraud risk, protects privacy, and whether Bitcoin service providers can be trusted, the most common answer wasn’t “yes” or “no.”

It was “maybe.”

Uncertainty—not outright rejection— likely defines how people see Bitcoin’s ability to serve as a tool for financial freedom.

💡Finances & Bitcoin

Do people under more financial stress tend to turn to bitcoin?

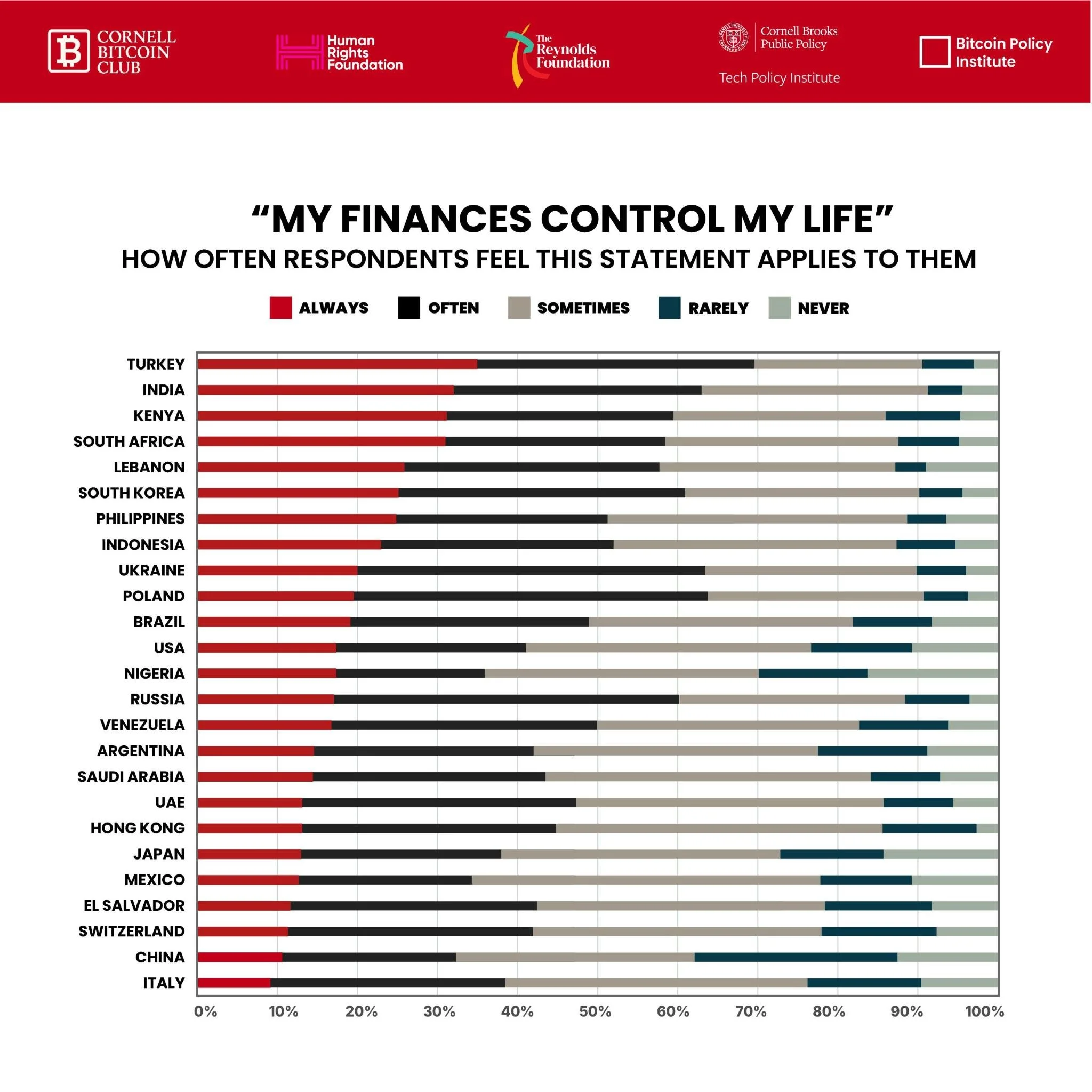

We asked respondents whether they agreed with the statement: “My finances control my life.” This chart offers emotional context, showing how financial stress varies globally and may influence openness to alternative financial systems.

🇹🇷 Turkey, 🇮🇳 India, 🇰🇪 Kenya, 🇿🇦 South Africa report the highest levels of financial stress.

🇸🇻 El Salvador, 🇨🇭 Switzerland, 🇨🇳 China, & 🇮🇹 Italy report the lowest.

When compared with ownership data, a tentative pattern emerges: countries reporting higher financial stress often also show higher Bitcoin ownership. Meanwhile, Mexico, Italy, and Japan rank at the very bottom across both stress and adoption.

📌 Of course, correlation ≠ causation. But the overlap raises an intriguing possibility: in places where financial stress is acute, bitcoin may appear not just as an investment, but as an alternative lifeline.

🧭 Takeaway

Across 25 countries, trust in Bitcoin averages 4.67/10, placing it below traditional assets such as gold, real estate, and national currencies.

In 10 countries, reported trust in Bitcoin exceeds trust in government, largely in contexts where institutional trust is already weak.

Perceived risk remains high relative to most other assets, which may constrain broader adoption.

Responses to questions about fraud, privacy, and service providers were dominated by “maybe,” suggesting uncertainty rather than clear endorsement or rejection.

Higher reported financial stress often coincides with higher levels of Bitcoin ownership and trust, though correlation does not imply causation.

Trust and risk shape how people see Bitcoin—but perception goes deeper.Over the next two weeks, we’ll explore how Bitcoin itself is perceived:

Overall, Bitcoin’s position is shaped less by uniform acceptance or rejection and more by patterns of uncertainty, comparative trust, and local economic context.🧑🤝🧑 Individuals and 🏛️ Governments

🔮 Looking Ahead

Trust and risk shape how people see Bitcoin—but perception goes deeper.

Over the next two weeks, we’ll explore how bitcoin is perceived.

Until then, all our open-source research is available at: 🔗 www.cornellbitcoinclub.org