Week 8: Perceptions of Bitcoin (Part I)

Over the past seven weeks, we’ve taken a past and present lens on bitcoin adoption.

Now, for the final three weeks of insights, we turn to the future:

👉 How do respondents across 25 countries perceive bitcoin—and what do they think about the likelihood of a transition to a Bitcoin standard?

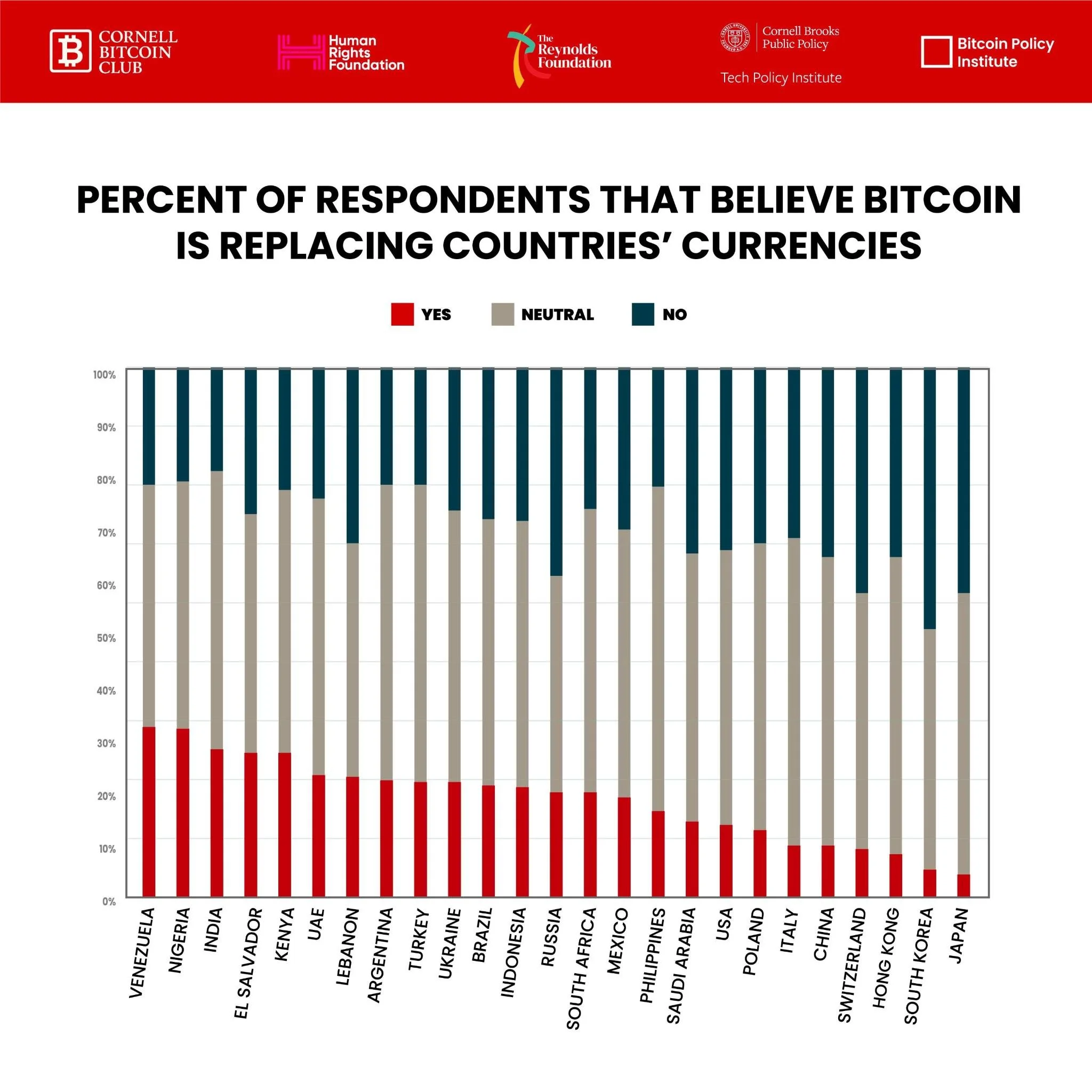

📌 Is Bitcoin Replacing Currencies?

We asked respondents on a scale of 1–7 how much they agree with the statement: “Bitcoin is replacing countries’ currencies.”

In 16 of 25 countries, the average response to the statement fell above the midpoint of the 1-7 scale.

Most positive: 🇻🇪 Venezuela (4.36/7), 🇳🇬 Nigeria (4.36/7), 🇮🇳 India (4.30/7)

Most skeptical: 🇨🇭 Switzerland (3.10/7), 🇯🇵 Japan (2.95/7), 🇰🇷 South Korea (2.80/7)

Takeaway: Belief in bitcoin as a currency replacement is strongest in high-inflation or unstable economies—and lowest in stable, high-income ones.

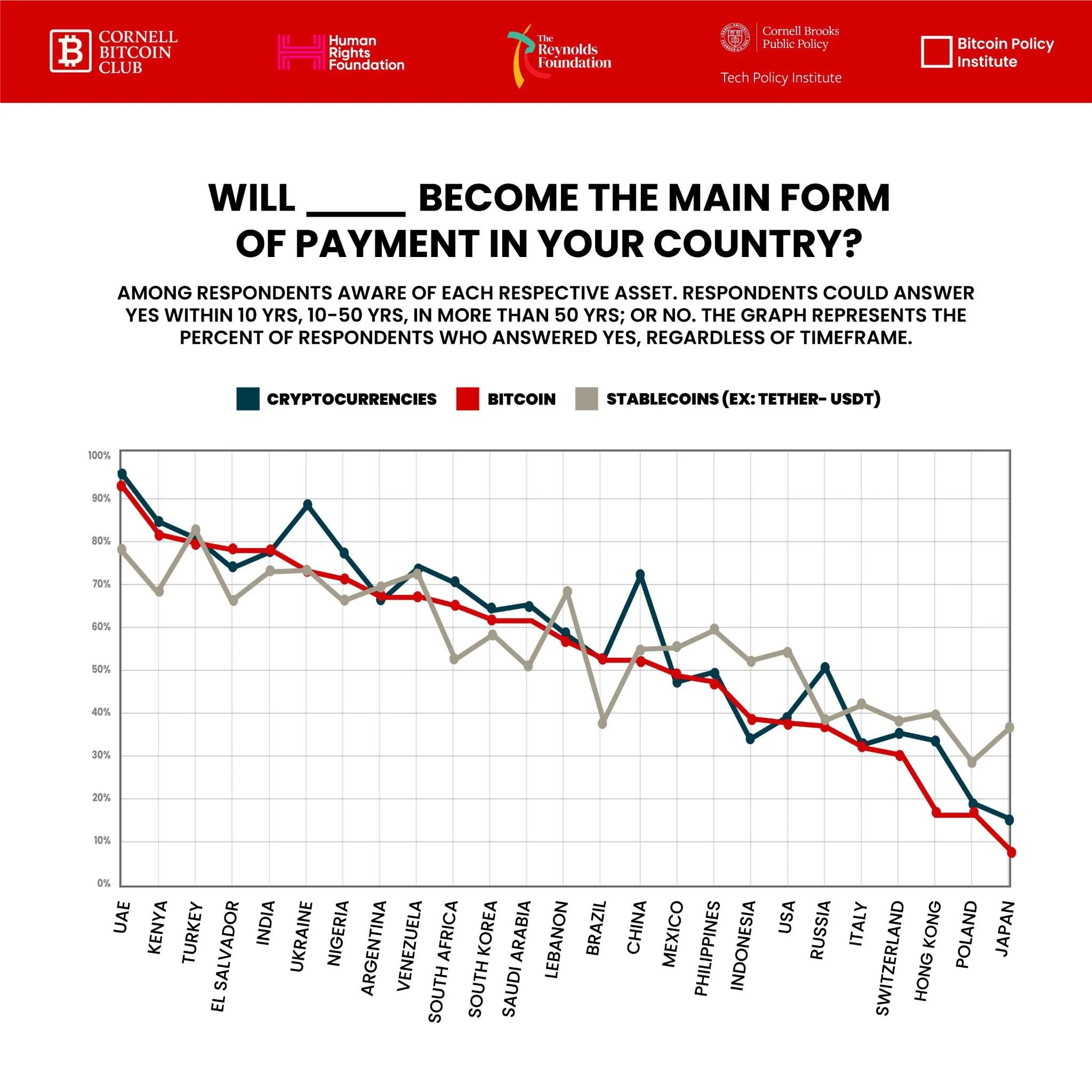

💡 Will Bitcoin Become the Main Form of Payment?

We then asked whether bitcoin, cryptocurrencies, or stablecoins will become the main form of payment in respondents’ countries—and if so, in what timeframe (within 10 years, 10–50 years, or beyond 50 years).

In 17 of 25 countries, a majority said yes to bitcoin.

Most optimistic: 🇦🇪 UAE (79%), 🇰🇪 Kenya (72%), 🇹🇷 Turkey (71%)

Most skeptical: 🇭🇰 Hong Kong (31%), 🇵🇱 Poland (31%), 🇯🇵 Japan (25%)

Stablecoins also play a notable role: in 16 of 25 countries, they were seen as more likely than bitcoin to become the main form of payment.

Takeaway: For many, the idea of digital money feels closer when it looks like the dollar.

📍 Consistency Across Measures

Looking across both questions (“Is Bitcoin replacing currencies?” and “Will Bitcoin become the main form of payment?”), 19 of 25 countries reported majority positive responses.

Only six countries fell below 50% on both measures: 🇺🇸 United States, 🇵🇱 Poland, 🇮🇹 Italy, 🇭🇰 Hong Kong, 🇨🇭 Switzerland, 🇯🇵 Japan.

Takeaway: Support for bitcoin’s future role is broad, but skepticism clusters in stable, developed economies.

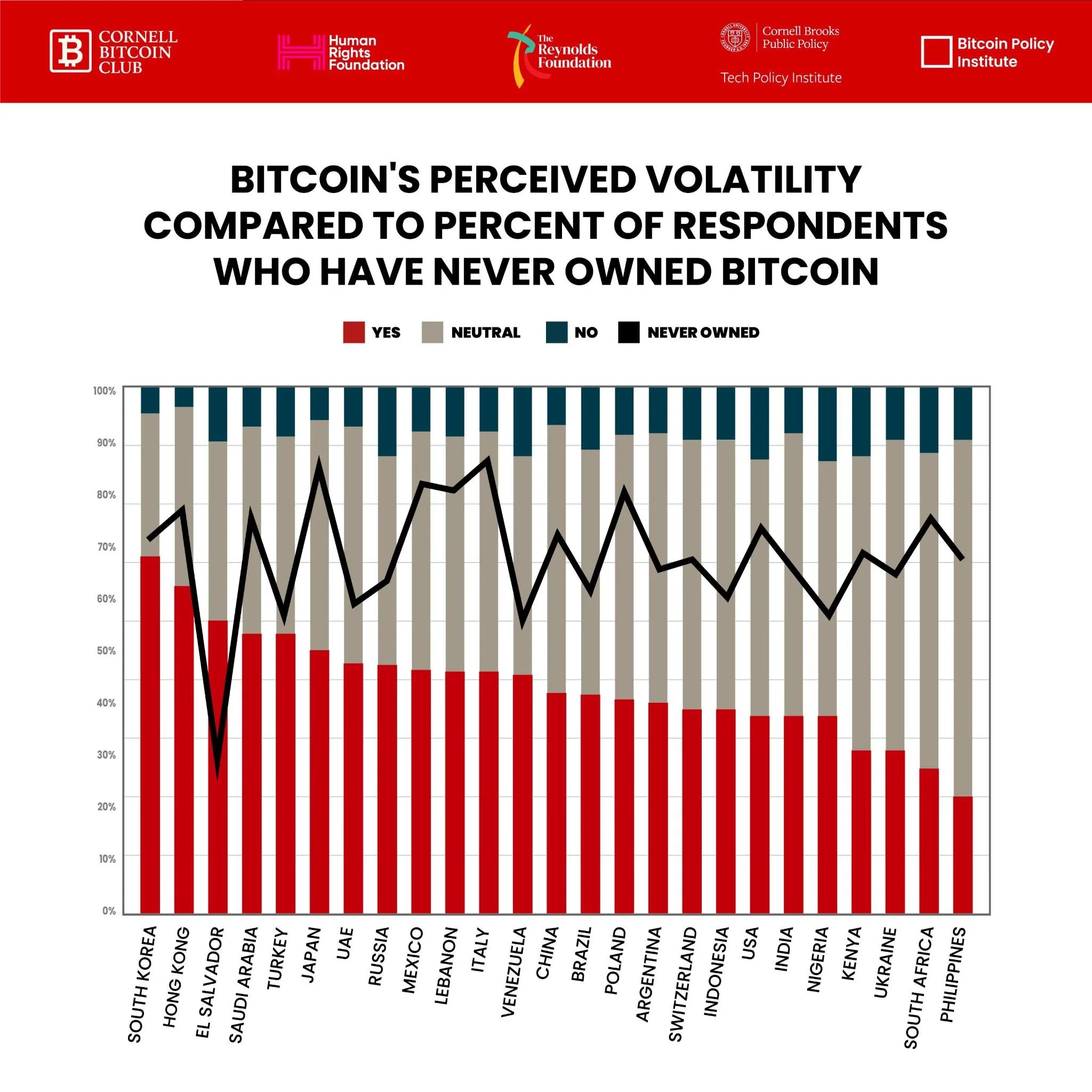

📊 Volatility & Ownership

In Week 5, we showed that “volatility” was not the most common barrier to adoption. Still, it remains an important perception.

On a 1–7 scale, we asked respondents whether they agreed: “Bitcoin is volatile.”

Most likely to agree: 🇰🇷 South Korea, 🇭🇰 Hong Kong, 🇸🇻 El Salvador

Least likely to agree: 🇺🇦 Ukraine, 🇿🇦 South Africa, 🇵🇭 Philippines

Overlaying this with ownership data reveals a relationship: countries where more respondents see Bitcoin as volatile also tend to report higher percentages of people who have never owned it.

🇭🇰 Hong Kong: #6 in “never owned”

🇿🇦 South Africa: #8

🇰🇷 South Korea: #11

🇵🇭 Philippines: #12

🇺🇦 Ukraine: #17

🇸🇻 El Salvador: #25

Takeaway: While not conclusive, these findings suggest that perceptions of volatility may be associated with lower ownership levels in certain contexts.

🧭 Takeaway

Perceptions of bitcoin’s future are highly context-dependent:

In emerging and high-inflation economies, majorities already view bitcoin as part of the monetary future.

Stablecoins are often considered more plausible than bitcoin for everyday payments, reflecting demand for digital dollars.

In more stable, high-income countries, skepticism dominates—often linked to volatility concerns.

The data does not forecast inevitability, but it does illustrate how people worldwide are actively imagining—and debating—the future of money.

🔮 Looking Ahead

Next week, we’ll continue to explore how bitcoin is perceived and how perceptions could be maintained and changed.

Until then, all our open-source research is available at: 🔗 www.cornellbitcoinclub.org