Week 5: Barriers to Bitcoin Adoption

“It’s for criminals.”

“It’s bad for the environment.”

“It’s too complicated.”

These are the lines you might expect to keep people from owning Bitcoin.

But when we asked 25,000 people across 25 countries, the most common answers didn’t match the usual headlines.

The real top barriers? Much more ordinary—and in many cases, more solvable.

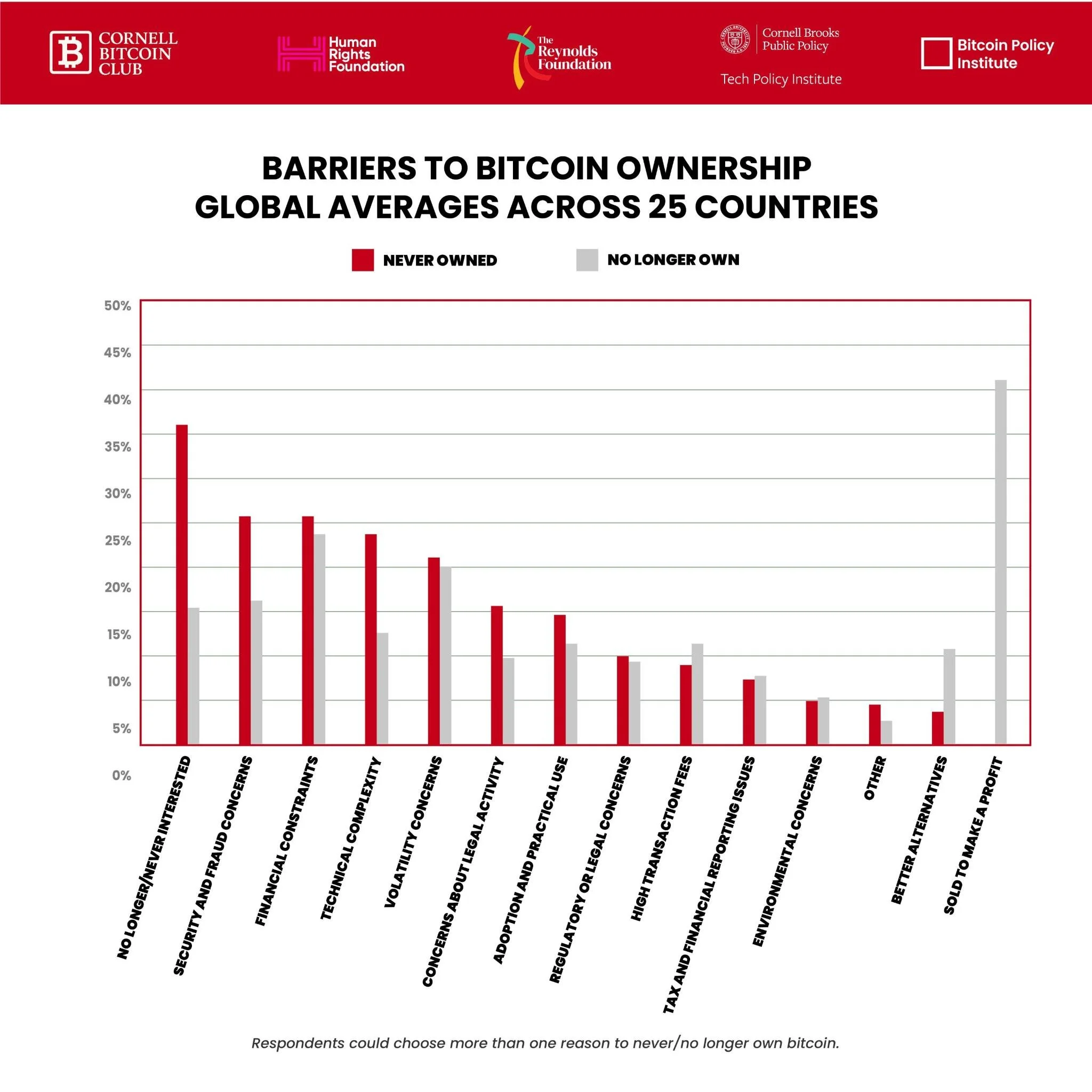

🚧 The Biggest Barriers

Globally, the #1 reason people no longer own Bitcoin? They sold to make a profit (42%).

For those who’ve never owned Bitcoin, the top barrier is simple: They’re not interested (37%).

After that, two concerns tie for second:

Security concerns (26%)

Financial constraints (26%)

At the bottom of the list:

Better alternatives (3%)

Environmental concerns (5%)

Tax and financial reporting issues (7%)

Takeaway: Many “barriers” aren’t permanent—they’re either practical, situational, or solvable with the right tools and education.

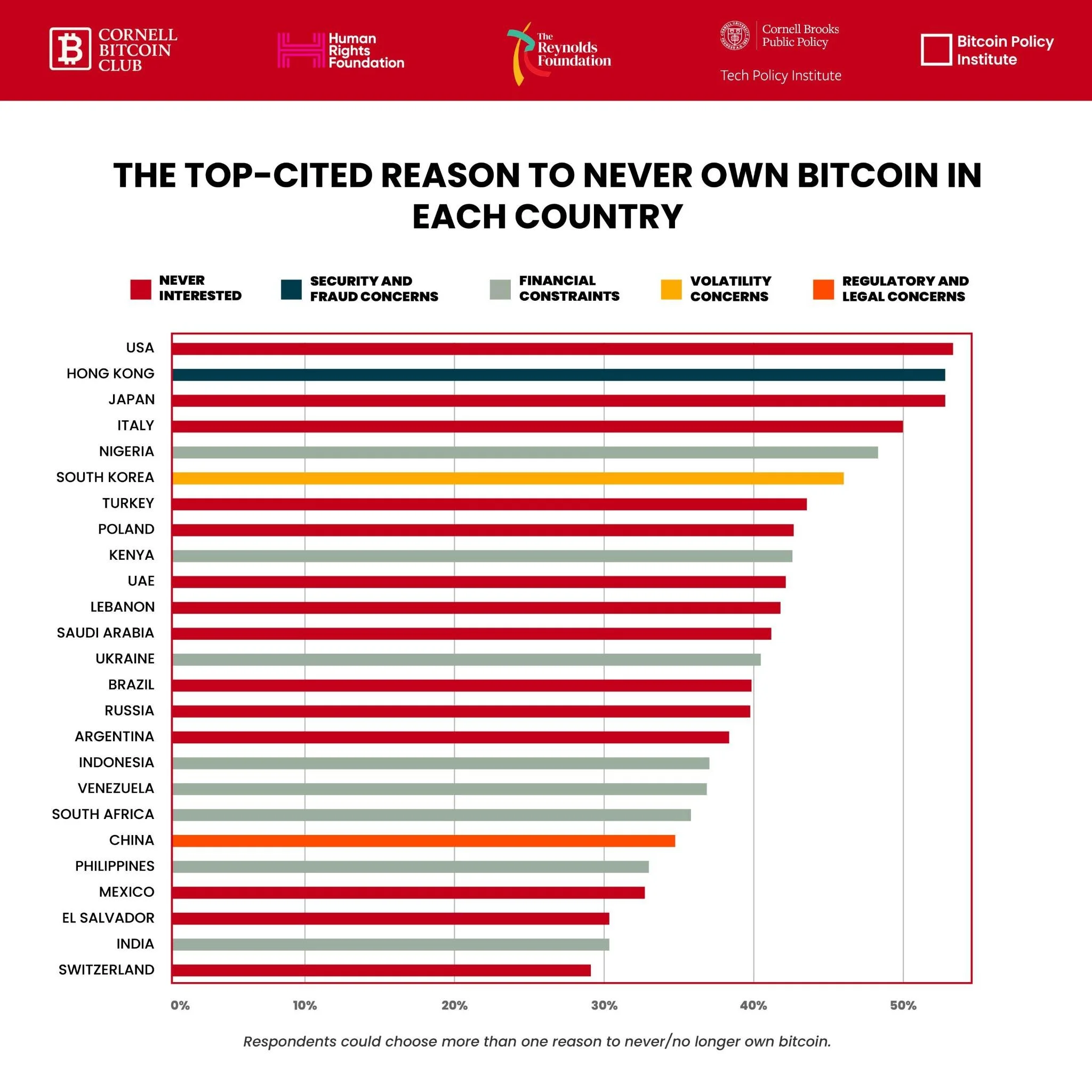

🌍 What the World Says

Across 25 countries, the same few reasons dominate:

14 countries: Never interested

8 countries: Financial constraints

1 country each: Volatility, security/fraud, or regulatory/legal concerns

The only region where the top concern wasn’t “never interested” or “financial constraints”? Asia—home to the only countries where volatility, security, or regulation topped the list.

Takeaway: Barriers are surprisingly borderless, with rare—but telling—regional exceptions.

🗺 Mapping the Barriers

When we look at every reason together, a pattern emerges:

Many barriers—like lack of interest, technical complexity, and low practical use—are design + education challenges.

Others—like financial constraints, volatility, and high transaction fees—are economic realities.

A few—like selling for profit—actually reflect Bitcoin’s strength as borderless, permissionless, censorship-resistant digital property.

Takeaway: Growing adoption isn’t just about technology—it’s about understanding, usability, and access.

🛠 Turning Barriers into Opportunities

The data doesn’t point to rejection. It points to opportunity.

For those working to scale Bitcoin adoption, possible next steps include:

Lower friction for barriers people can control (e.g., technical complexity) → h/t @satsie & @bitcoin_design

Support solutions for barriers people can’t control (e.g., financial constraints) → h/t @fold_app for passive sats stacking

Re-examine barriers people think they can’t control (e.g., security concerns) → h/t @River for their “ForceField” feature

Because inclusion starts with listening—and acting.

📌 Final Word

Bitcoin’s adoption story isn’t blocked by the headlines. It’s shaped by everyday realities.

And when you understand what’s actually in the way, you can start to clear the path.

🔜 Coming Next Week: What do people trust?

Next week, we explore an essential follow-up: What do or don’t people trust? And, how does bitcoin compare?

Until then, all our open-source research is available at: 🔗 www.cornellbitcoinclub.org