Week 3: How Do People Use and Hold Bitcoin? (Part 1)

Bitcoin was first introduced to the world as a “Peer-to-Peer Electronic Cash System.”

But what does it really mean to use Bitcoin?

Do you:

— Send payments?

— Stack sats?

— Memorize your seed phrase?

This week, we explore what use actually looks like in practice—across 24 countries and thousands of voices. Is Bitcoin being saved? Spent? Stored? The answer, as always, depends on context.

💰 Savings & Investments

Last week, we shared that 13% of global respondents reported owning Bitcoin.

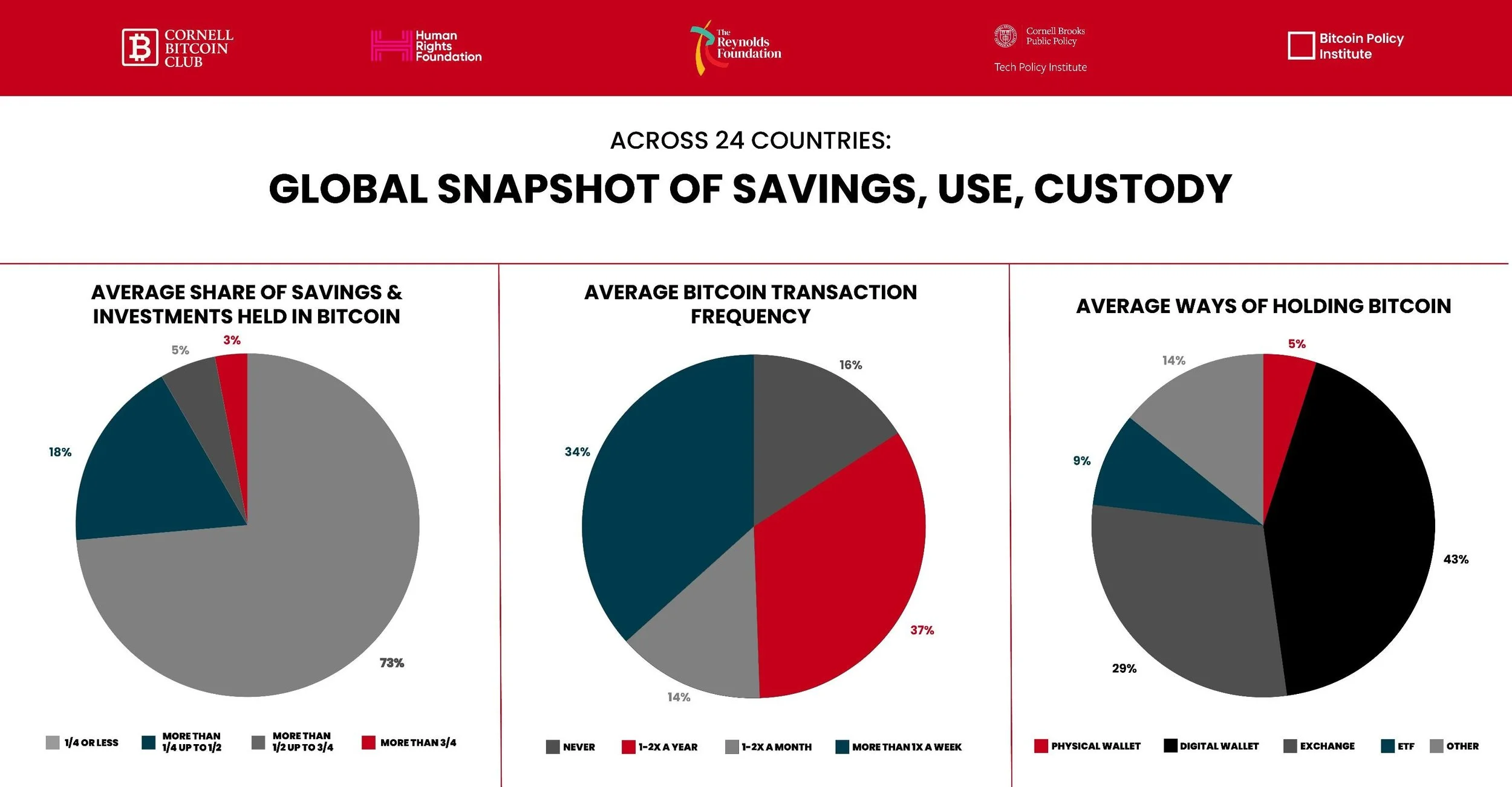

But this week we asked: What portion of your savings or investments is in Bitcoin?

This gives us a clearer sense of conviction—not just if someone owns bitcoin, but how much value they place in it.

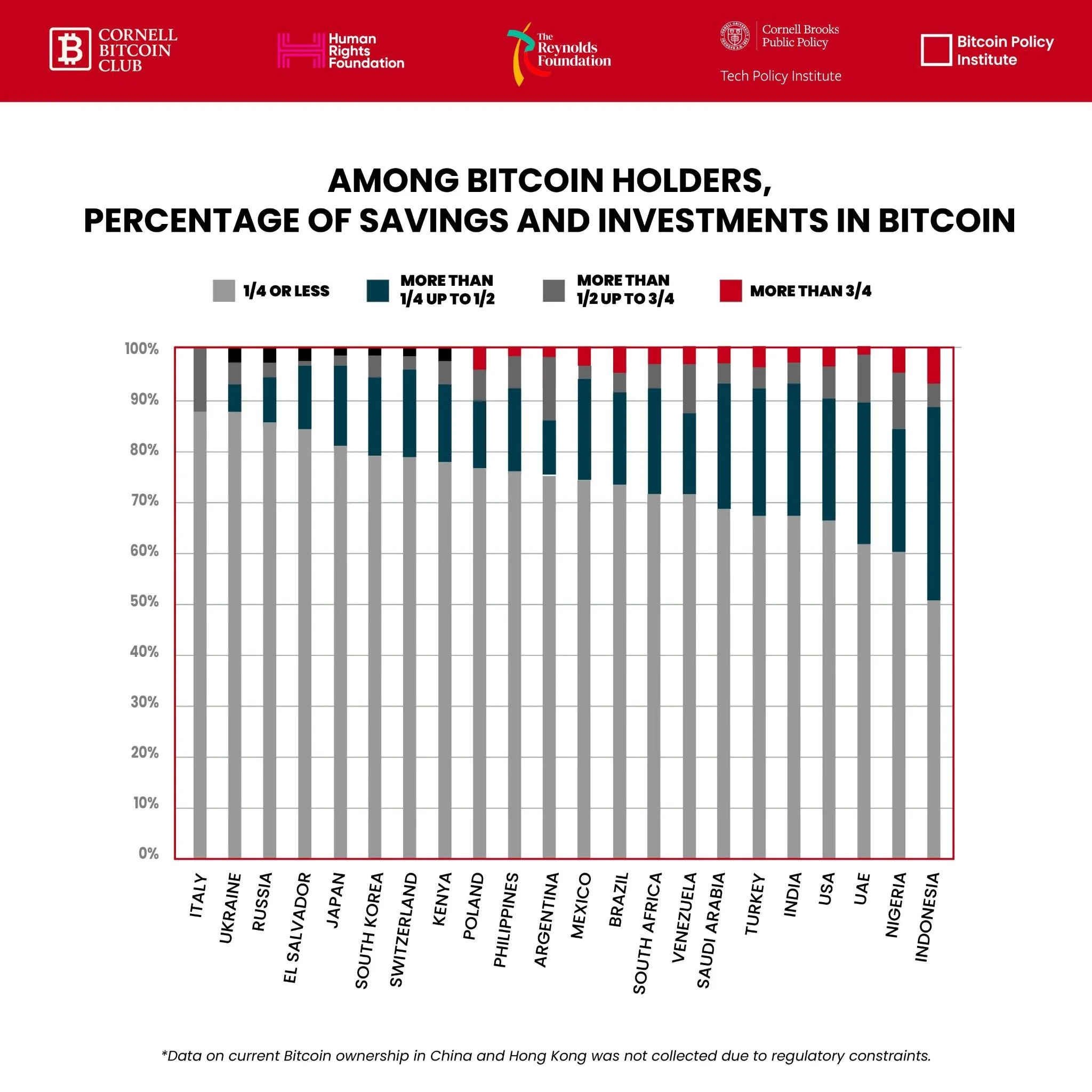

Most people around the world who own Bitcoin keep it as a small part of their portfolio. But several countries stood out for having the highest percentage of holders allocating 75% or more of their savings into Bitcoin:

🇮🇩 Indonesia

🇳🇬 Nigeria

🇧🇷 Brazil

🇿🇦 South Africa

🇵🇱 Poland

What drives this kind of high conviction?

From our interviews and data, a few common threads emerged:

🔁 Limited trust in traditional banking systems

💸 High inflation or currency instability

🌍 Fewer accessible investment alternatives

💡 Grassroots financial education and peer-to-peer influence

In Poland, we learned that the country has one of Europe’s highest concentrations of Bitcoin ATMs. In South Africa, Pick n Pay—one of the nation’s largest retailers—has accepted Bitcoin payments in every store since 2023. When alternatives flourish, behavior shifts.

💸 Spending: Peer-to-Peer in Practice

How often do people actually transact with Bitcoin?

Among respondents who have ever owned Bitcoin:

🟠 16% said they never used it (meaning 84% have)

🟠 37% use it 1–2 times per year

🟠 14% use it monthly

🟠 34% use it more than once a week

So yes—around the world, people are spending their Bitcoin.

But where, how, and how often depends on much more than ownership alone.

🌍 A Few Country Snapshots

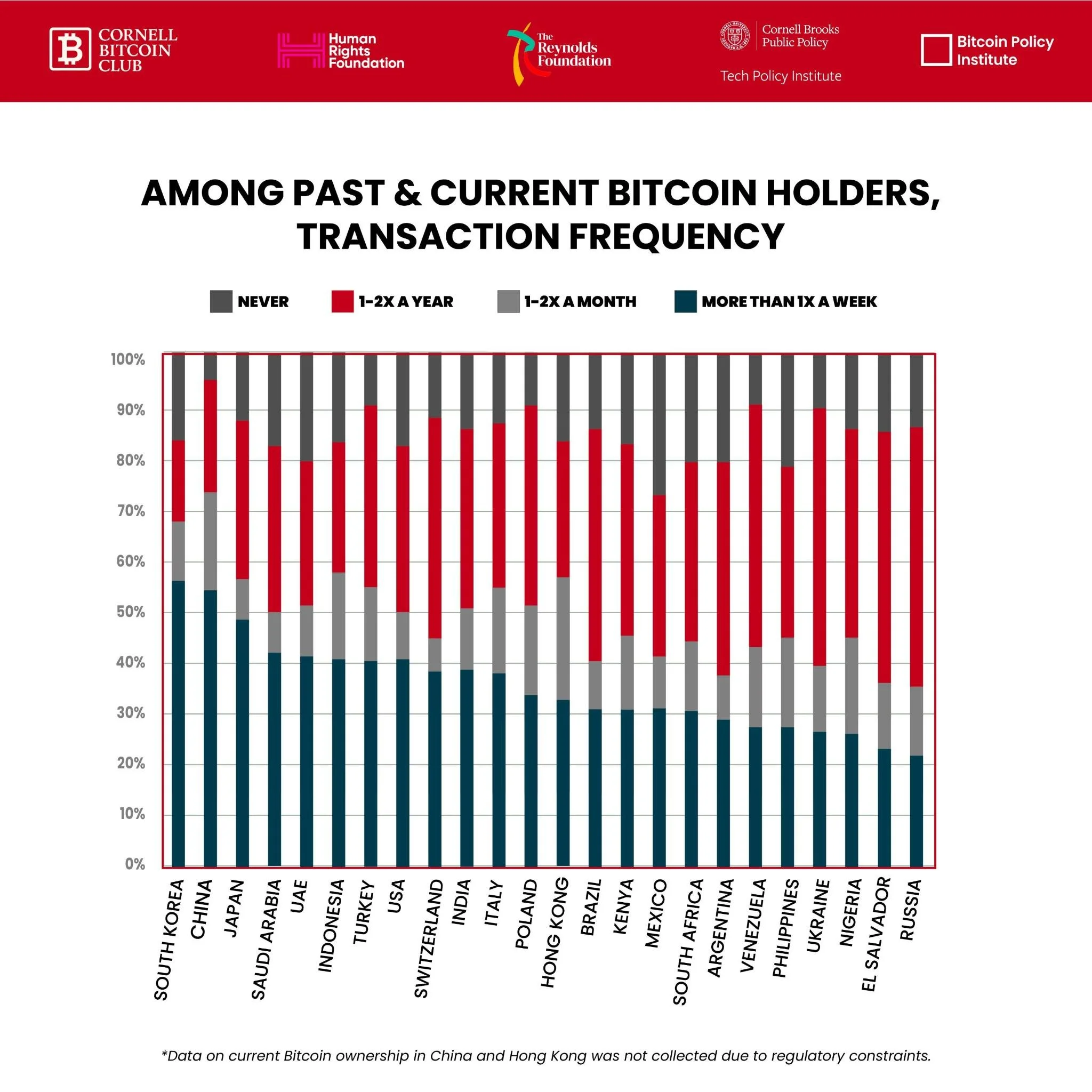

🇸🇻 El Salvador: Despite having the highest Bitcoin ownership rate in our study, El Salvador reports relatively low transaction frequency. This may suggest what many have suspected: adoption can’t be forced. Legal mandates don’t guarantee meaningful use.

🇨🇭 Switzerland & 🇮🇳 India: Two very different regulatory climates. Similar patterns in usage.

Switzerland has been crypto-friendly for over a decade—Zug was dubbed “Crypto Valley” as early as 2013. India, on the other hand, has faced shifting legal landscapes: a 2018 exchange ban, overturned in 2020, followed by a steep 30% tax on crypto gains in 2022. Despite these contrasts, both countries report above-average weekly Bitcoin use.

This suggests something deeper: demographics, culture, and social narratives may matter as much—or more—than policy alone.

🇻🇪 Venezuela: A compelling case study: Venezuela consistently shows high levels of both ownership and transactional use. Here, Bitcoin acts as a financial lifeline—a way to store and move value in an inflationary economy. For many, its use is not speculative—it’s survival.

🔐 Custody & Control

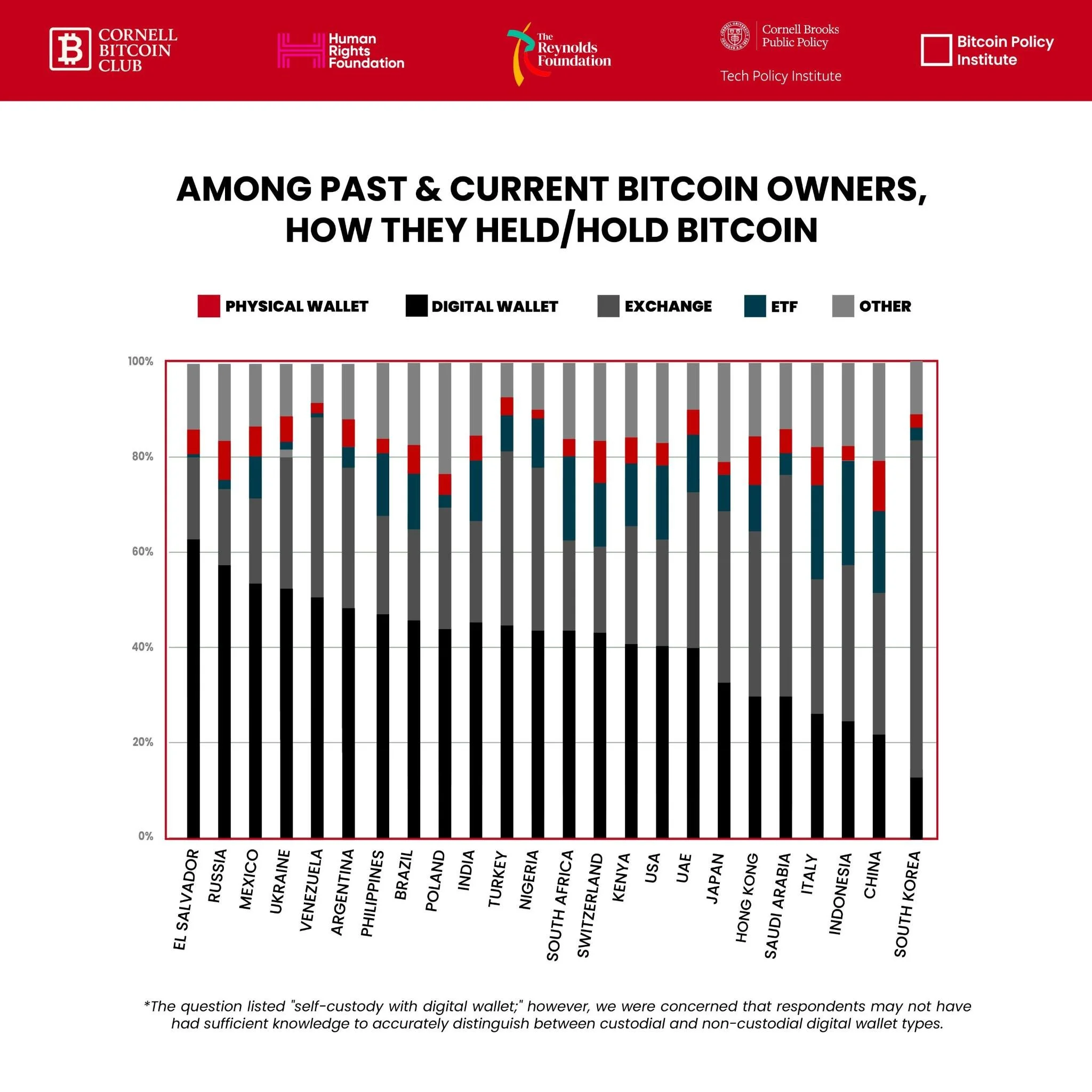

We also examined how people store their Bitcoin.

While most respondents reported using a “digital wallet,” we found that many struggle to distinguish between custodial (someone else controls your keys) and non-custodial (you control your keys) wallets.

Take El Salvador: Many people use the Chivo Wallet, which is custodial—yet many likely believe they’re holding the bitcoin directly.

In South Korea, ownership is relatively low, but among those who do own Bitcoin, over 50% use it weekly—the highest frequency in our study. This high velocity likely reflects trading behavior rather than long-term holding. Most of these users rely heavily on exchange custody, with very little self-custody or hardware wallet usage. Interviews suggest lingering distrust from the Terra/Luna collapse in 2022 still shapes user behavior.

Meanwhile, physical hardware wallet use was highest in:

🇭🇰 Hong Kong

🇨🇳 China

🇷🇺 Russia

🇨🇭 Switzerland

🇮🇹 Italy

Still, the global takeaway is clear: Most people don’t yet understand bitcoin custody—and that has major implications for education and sovereignty.

🧭 Final Takeaways

Using Bitcoin doesn’t always mean spending it. Sometimes, it means saving it. Sometimes, it means protecting it. And often, it means doing all—depending on who and where you are.

“Use” looks different in every context, shaped by:

Legal frameworks

Economic pressures

Demographics

Cultural narratives

Historical memory

This isn’t just about behavior—it’s about belief. And that’s where we’re headed next.

🔮 Coming Up Next: Why?

Next week, we go deeper.

Why do people choose bitcoin at all?

Until then, you can explore all the open-source data and insights at: